Mar 16, 2020

Gasoline, Diesel, Jet Fuel Prices Are Collapsing on Coronavirus

, Bloomberg News

(Bloomberg) --

Transport-fuel prices are crashing as the coronavirus outbreak shuts down swathes of the world’s economy, limiting the movement of people.

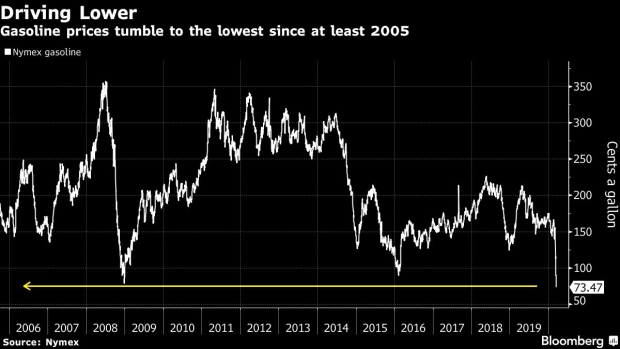

U.S. gasoline futures fell to their lowest since 2005, when they began trading. The plunge has sent the fuel -- usually one that refiners seek to maximize output -- close to being loss-making. The meltdown also extends to jet fuel and diesel markets as the impact of the coronavirus outbreak on people’s movement grows worldwide.

With airlines cutting the number of flights daily and a growing number of European countries in lockdown, oil markets are heading for an unprecedented glut. Meanwhile, Saudi Arabia and Russia are planning to boost crude production as they engage in a price war for market share.

“Demand is going to stay weak at a time when crude oil is just being pumped like mad out of the ground,” said Steve Sawyer, director of refining at Facts Global Energy. “Anything to do with petrol, diesel, jet fuel, obviously, is going to struggle.”

Nymex gasoline was trading at 72.92 cents a gallon by 10:07 a.m. London time. It was at a premium of 82 cents a barrel to WTI crude, down from almost $18 in intraday trading on March 10. At the same time, diesel and jet fuel prices in northwest Europe fell to their lowest intraday levels since early 2016.

--With assistance from Javier Blas.

To contact the reporters on this story: Alex Longley in London at alongley@bloomberg.net;Jack Wittels in London at jwittels1@bloomberg.net

To contact the editors responsible for this story: Alaric Nightingale at anightingal1@bloomberg.net, Brian Wingfield, Helen Robertson

©2020 Bloomberg L.P.