Feb 16, 2024

German Direct Investment in China Rose To Record In 2023

, Bloomberg News

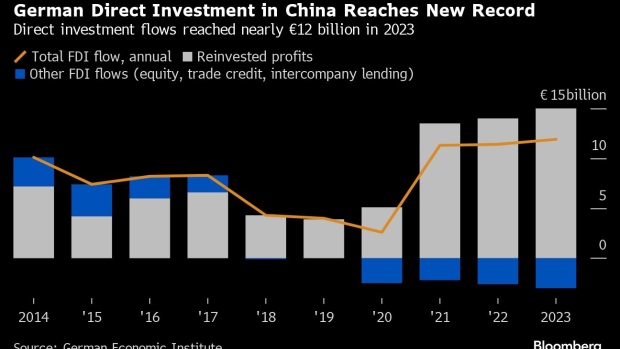

(Bloomberg) -- German companies’ direct investment into China reached a record of nearly €12 billion ($13 billion) last year, demonstrating an eagerness to expand in the world’s number two economy even while the European Union steps up scrutiny of these investments because of security concerns.

Investment in China as a share of Germany’s total direct investment abroad expanded to 10.3% last year, the highest since 2014, according to a German Economic Institute report based on data from the Bundesbank. The investment was financed by the retained profits of German-controlled enterprises in mainland China and Hong Kong, it found.

Germany in July published a China strategy that called on the country’s biggest companies to reduce their dependence on China, and for stronger policies to counter risks connected with outbound investment. The European Union has also moved to tighten oversight of FDI due to fears about the transfer of technology with military applications — drawing criticism from Beijing.

The latest investment data show there is “no trend” of diversification away from China, according to the report. Anecdotal data suggests that the rise in investment is driven by larger companies, it added.

“Especially larger German companies still see China as a large and growing market with an immense customer base,” the report’s author Jürgen Matthes said. German firms often plan to base more of their business activities in China to hedge against risks emanating from rising global trade tensions, he added.

A survey published last month by the German Chambers of Commerce in Greater China found that 73% of large companies operating in China plan to increase investment over the next two years, compared to 50% among the smallest companies.

The European Commission has been working on an outbound investment screening policy which would mirror efforts by the US to control companies’ investments into China. But pushback from member states meant the publications last month of more limited proposals than had been initially planned.

Because of US pressure for Europe to fall in line with its own controls, it’s in EU’s countries’ interests “to set up a European solution, instead of being forced to follow the US version,” said Matthes.

The German Economic Institute’s analysis is based on balance-of-payments data, and so doesn’t distinguish between greenfield investment involving the construction of new facilities China or the purchase of Chinese financial assets by German companies.

The report also showed that categories of FDI such as inter-company loans and equity injections by German companies into China have been falling.

Outbound investment in some parts of China has come under scrutiny from campaigners targeting it on ethical grounds. Volkswagen AG said this week it was reviewing activities in the western region of Xinjiang following new allegations of human-rights abuses at a project there. Chemical company BASF SE said this month it was speeding up divestment from the region over separate forced-labor allegations. China denies abuses in the region.

In a separate report published this week, the US-based Rhodium Group said Bundesbank data suggested German companies are increasingly reinvesting their made-in-China profits inside the country, to lower their costs.

As part of that trend, companies like automaker Volkswagen and BASF are reducing their footprint in the German market while increasing China-based jobs, research and development and, — in some cases — the production of goods destined for export, the report said.

“The surge in investment in China, and recent wave of downsizing in Germany, suggests that a gap is emerging between the financial interests of some German corporations, on the one hand, and the interests of their Germany-based staff and the broader German economy, on the other,” the Rhodium report added.

©2024 Bloomberg L.P.