Feb 16, 2020

Hedge Funds Bet Aussie Will Overcome Impact of Coronavirus

, Bloomberg News

(Bloomberg) -- Is the Australian dollar close to a turning point? Some hedge funds seem to think so.

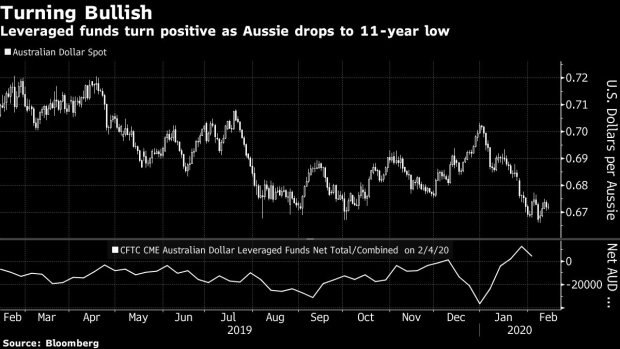

Leveraged investors have turned positive on the Aussie in recent weeks even as the spread of the deadly coronavirus in China saw the currency slide to the weakest level in almost 11 years. One of the main arguments from Aussie bulls is that a resilient local economy will rule out further interest-rate cuts, giving the battered currency room to recover.

Hedge funds held a net long position in the Australian dollar of 4,044 contracts in the week ended Feb. 4, compared with net shorts of 36,264 at the end of last year, according to the latest data from the Commodity Futures Trading Commission. The relatively small position though suggests they are still far from certain the bottom has been reached.

One of the factors helping the Aussie bounce off its 11-year low of 66.60 U.S. cents set last week was the positive noises coming from the Reserve Bank of Australia. The currency rallied as much as 0.8% on Feb. 4 when the central bank kept rates on hold and suggested it may refrain from any further easing this year.

RBA Governor Philip Lowe told a parliamentary panel a few days later there’s a growing risk interest rates may already be too low. As a caveat, however, he added that the argument may turn in favor of more easing if the labor market deteriorates.

All of which means the next batch of job data due this Thursday loom as a key event in determining the currency’s future. Economists are predicting the unemployment rate crept up to 5.2% in January from 5.1% the previous month, according to a Bloomberg survey. A healthy beat in the numbers may see the Aussie’s nascent recovery start to gain some real traction.

At the same time, the local dollar will remain at the mercy of the coronavirus, which has led to a vast shuttering of factories in China, threatening Australian exports. While the Aussie remains vulnerable to any worsening in the outbreak, there are at least some signs that the situation may be starting to stabilize.

- Monday, Feb. 17: New Zealand performance services index, Japan 4Q GDP and industrial production, Indonesia trade balance, overseas workers remittances, Singapore NODX and 4Q GDP, Thailand 4Q GDP

- Tuesday, Feb. 18: RBA minutes, Singapore budget

- Wednesday, Feb. 19: Australian skilled vacancies and 4Q wage price index, Japan trade balance and core machine orders

- Thursday, Feb. 20: Australian employment, Australian PPI, China 1-year and 5-year loan prime rates, South Korea PPI, Bank Indonesia rate decision, BoP overall

- Friday, Feb. 21: Japan CPI and PMIs, South Korea 20-days imports/exports, Malaysia CPI

--With assistance from Ruth Carson.

To contact the reporter on this story: David Finnerty in Singapore at dfinnerty4@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Nicholas Reynolds

©2020 Bloomberg L.P.