Apr 17, 2024

Hedge Funds Including Millennium Are Shorting UK Water Companies

, Bloomberg News

(Bloomberg) -- Hedge funds including Millennium Management and Arrowstreet Capital are shorting the assets of UK water companies after a crisis at Thames Water spotlighted high debt levels across the industry.

Millennium has disclosed a short position on United Utilities Group Plc, which provides water and wastewater services in the north west of England. ArrowStreet has a short position on Pennon Group Plc, which owns three water utilities in the south west of England.

The debt of water utilities including Southern Water Services Finance Ltd and Yorkshire Water Finance Plc have also been targeted, according to two people involved in those transactions, who asked not to be named because details are private.

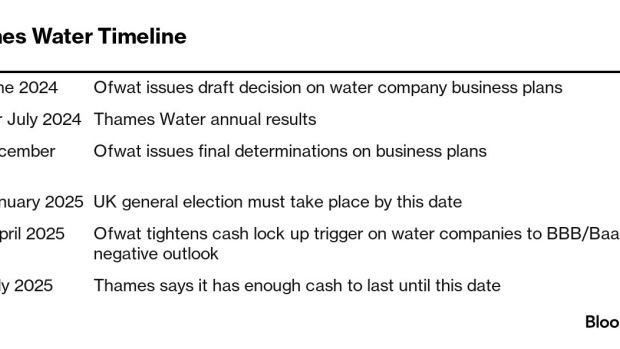

Britain’s highly-indebted utility companies are facing scrutiny on fears they might face a similar fate to Thames Water, which is struggling to raise equity amid a standoff between shareholders and the regulator Ofwat. The deepening crisis led to the default of the firm’s parent company earlier this month and creditors are concerned the government may decide to bring it under special administration.

At least one key bondholder has also raised concerns that a potential haircut to Thames Water’s £16 billion ($20 billion) of debt could hurt confidence in the entire sector and the government’s willingness to protect regulated assets.

United Utilities declined to comment. Pennon, Southern and Yorkshire didn’t respond to emailed requests for comment.

Short interest on United Utilities had jumped to almost 7% on April 12 from 2% in July last year, according to data compiled by S&P Global Market intelligence. It has since eased to 5.3%. Short interest in Southern Water bonds jumped this week, with 6.6% of the notes maturing in May 2028 being out on loan, from around 0.8% at the start of the year, the data show.

Read More: HSBC, Barclays Making Markets for Thames Water Short Bets

GLG Partners had a short position on United Utilities shares as of April 10, but it has since dropped out of regulatory filings. A bet worth 0.5% of shares outstanding requires firms to report to the UK regulator. The firm declined to comment on its holdings.

Thames Water was identified by Ofwat in December as one of Britain’s most indebted water utilities. But the country’s other providers are also shouldering high debt loads. Five others, including Yorkshire, have gearing of 70% or more. Gearing is Ofwat’s preferred measure of debt as a proportion of the regulatory capital base.

The spread on Yorkshire Water’s April 2035 bonds issued last year have widened 25 basis points since the start of the month to a 2024-high of 194 basis points over benchmark debt. A note recently issued by Southern Water Finance has widened more than 40 basis points since pricing in late March.

©2024 Bloomberg L.P.