Apr 11, 2024

HSBC, Barclays Are Making Markets for Thames Water Short Bets

, Bloomberg News

(Bloomberg) -- Credit traders at Barclays Plc and HSBC Holdings Plc are among those making a market for clients to bet against the debt of Thames Water amid an escalating crisis at the UK’s largest water utility.

Traders on the London credit desk of the two British banks started facilitating wagers against the debt, according to people familiar with the matter, who asked not to be identified because they’re not authorized to talk about the transactions. Traders at Goldman Sachs Group Inc. are providing a similar service, some of the people said.

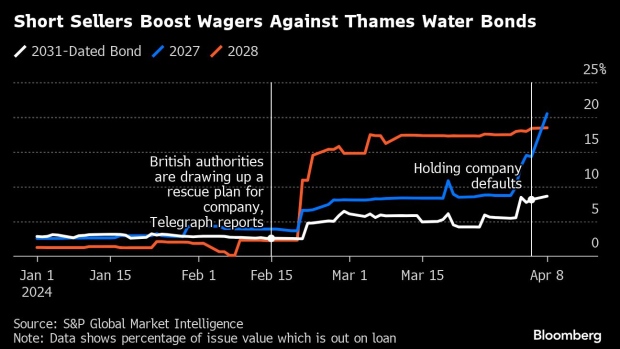

Short interest on some Thames Water bonds has surged since parent company Kemble Water Holdings Ltd. defaulted last week after shareholders refused to inject more capital following a standoff with water regulator Ofwat. Investors are now betting that some kind of restructuring of Thames Water’s £16 billion ($20 billion) debt pile is likely if a solution can’t be found to break the deadlock.

In one bond maturing in 2028, short interest now amounts to almost 18.5% of the percentage value at issuance, compared to 1.26% at the start of the year, according to data compiled by S&P Global Market Intelligence.

Creating markets for short selling is standard practice and an important revenue stream for big banks, and it doesn’t necessarily reflect their house views on the situation at Thames Water. In this case, the banks’ involvement in the Thames Water trades could associate the firms with the deepening debt crisis at the utility, which supplies water to a quarter of England, including London.

Representatives for HSBC, Barclays and Goldman Sachs declined to comment.

The crisis at Thames Water came to a head last month when Ofwat announced that it won’t support the firm’s next five-year plan. The plan envisioned raising bills 40% to cover the cost of infrastructure improvements and rising debt obligations. Prime Minister Rishi Sunak’s administration has been pushing Thames Water to resolve its financial difficulties alone, with ministers rejecting pressure to bring the firm into special administration.

A group of Thames bondholders has hired advisers ahead of potential restructuring talks.

Recently issued debt by other water utilities such as Southern Water and Northumbrian Water have also been impacted by the crisis at Thames Water. Southern Water’s April 2040 bonds have seen their spread over the benchmark widen to 288 basis points. It priced at 255 basis points over the reference gilt in March.

--With assistance from Neil Callanan.

(Adds bonds of other water utilities in last paragraph.)

©2024 Bloomberg L.P.