May 17, 2021

Hungary Takes Pole Position for EU’s First Rate Hike of 2021

, Bloomberg News

(Bloomberg) --

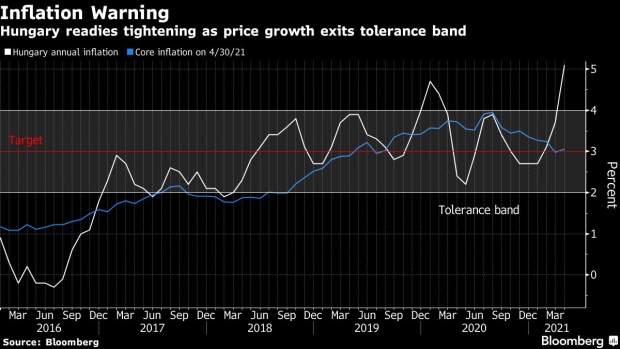

Hungary moved into pole position to implement the European Union’s first interest-rate hike since the pandemic as soaring inflation prompts policy makers to act in the bloc’s east.

The nearby Czech Republic had been the EU’s most likely first mover until Hungarian central bank Deputy Governor Barnabas Virag said Monday that surging prices will be met by tighter monetary policy as soon as next month -- sparking gains in the forint.

The bank should consider lifting its benchmark rate in June as part of a “data-driven” tightening cycle carried out in several steps, Virag told a briefing in Budapest. Even in the event of a hike, quantitative easing will continue, with the program to only be wound down gradually, he said.

“Inflation risks have unequivocally risen,” Virag said. “The central bank wishes to respond to sustained inflation risks via the benchmark rate.”

Talk of rate hikes in the EU’s east comes as the world’s major central banks say they’ll maintain loose monetary policy amid a bout of inflation they deem temporary. Virag’s comments mark a break from what had up to now been a wait-and-see approach to inflation in Hungary. Consumer prices jumped 5.1% in April -- the EU’s fastest pace and already more than the 5% peak the central bank had earlier projected.

Hungary last raised borrowing costs in September, when the one-week deposit rate was lifted to 0.75%, 15 basis-points above the benchmark. While Virag didn’t say how much the benchmark would rise this time around, he said it needs to have an “effective” impact on asset markets.

The government’s forint bond yields rose across the curve, with 10-year rates adding to their steepest loss in more than a year last week. The benchmark three-year note led declines with the yield rising 12 basis points to 1.64% on Monday.

The forint strengthened as much as 0.7% per euro to 352.64 at 10:26 a.m. in Budapest, the strongest since December.

Government debt costs have risen despite 2.1 trillion forint ($7.2 billion) of bond purchases by the central bank. Virag said weekly QE volumes could be increased from the current 60 billion forint if needed.

“Our sovereign bond purchase program is the most effective tool to stabilize the long end of the yield curve,” he said. “That’s why phasing out the program requires extraordinary caution to maintain market stability.”

©2021 Bloomberg L.P.