Sep 13, 2022

Inflation Fails to Slow US Economy, Forcing Fed to Brake Harder

, Bloomberg News

(Bloomberg) -- The US economy has shown surprising resilience in the face of the fastest inflation and interest-rate hikes in a generation. That means the Federal Reserve will have to stomp even harder on demand.

What started as a pandemic-driven supply shock has morphed into widespread inflation rooted just as much in resilient demand, underscored by unexpectedly high numbers that dashed hopes price gains were ebbing. While consumers are showing some signs of slowing, they’re still largely keeping up with persistent price pressures, powered by historic wage gains.

All told, the Fed has a much harder task on its hands than previously thought. If Americans won’t dial back spending further, odds favor the central bank becoming that much more aggressive to take more wind out of the economy’s sails with the goal of bringing inflation down.

“It tells you that it’s going to take a longer time, and will require higher rates -- and in macro language, maybe even require more demand destruction,” as in higher unemployment and slower growth, said Torsten Slok, chief economist at Apollo Management. “It raises the probability of a recession.”

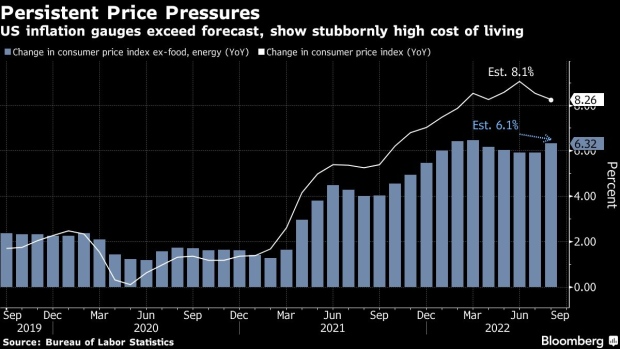

Consumer prices advanced by more than forecast in August, defying expectations for a monthly drop due to falling gasoline prices. Shelter, food and medical care were among the largest contributors to price growth, underscoring the breadth and severity of inflation with several categories posting record increases.

The S&P 500 fell more than 4% in the worst day since June 11, 2020, while Treasury yields and the dollar rose.

“My experience with inflation is that some of the components that were very strong in today’s report, they tend to be sticky and have a lot of inertia,” like rent, said Blerina Uruci, US economist at T. Rowe Price Associates. “So I would expect those to remain pretty strong in the coming months.”

The Atlanta Fed’s so-called sticky CPI measure rose 6.1% in August from a year ago, the biggest gain in 40 years. Meantime, the Cleveland Fed’s median CPI, which excludes categories with the largest price changes, increased by the most in data back to 1983.

Excluding the volatile food and energy categories, the so-called core CPI climbed 0.6% from July, double the median estimate in a Bloomberg survey of economists. The core measure rose 6.3% from a year ago, the first acceleration in six months and near a four-decade high, the Labor Department’s report showed.

“The composition is even more troubling than the aggregate reading,” Stephen Stanley, chief economist at Amherst Pierpont Securities, said in a note. “Outside of falling gasoline prices, inflation appears to be just as hot as ever, which means that the Fed still has plenty of work to do.”

It also means that the Biden administration and fellow Democrats have plenty of work to do, as the latest data may threaten what had been growing optimism in the party that they would hold their congressional majorities in November.

Fed Bets

Traders are now fully expecting the central bank to raise interest rates by another 75 basis points when policy makers meet next week, which would be the third-straight hike of that size. They’re also upping bets that officials will go bigger at their November gathering and see the tightening cycle peaking around 4.3% early next year -- more than a quarter-point higher than what was projected before the CPI report.

Chair Jerome Powell has communicated a stronger resolve to stamp out inflation since the Fed’s summit in Jackson Hole last month, signaling that the central bank is likely to keep raising interest rates and leave them elevated for a while. He’s stuck to that hawkish view and several of his colleagues also support hiking rates to a point that more clearly restricts demand.

Read more: Fed Seen Being Aggressive for Longer After US Inflation Surprise

Consumer spending, while slowing, hasn’t fallen off a cliff by any means. And with gasoline prices dropping more than 10% in August, Americans may even feel more emboldened to step up their discretionary purchases elsewhere.

Retail sales excluding gas and autos are projected to have risen last month, in data to be released later this week, which will factor into stronger growth overall. Those figures aren’t adjusted for inflation.

Powering much of this demand is a tight labor market, marked by robust job growth and historically low unemployment. Wage gains, though lagging inflation, are still extremely elevated, making the Fed’s job of reigning in demand even harder.

“The surprisingly strong core CPI in August -- when most thought lower gasoline prices would push down other prices as well -- indicates that wages have now become the top driver of inflation,” Bloomberg economists Anna Wong and Andrew Husby said in a report.

“With Fed officials already highly concerned about a potential wage-price spiral, the central bank is likely to keep hiking in the first half of 2023,” they said.

(Adds market in sixth paragraph)

©2022 Bloomberg L.P.