Sep 12, 2022

Japan’s Top Refiner Is Gearing Up for the Oil Industry’s Decline

, Bloomberg News

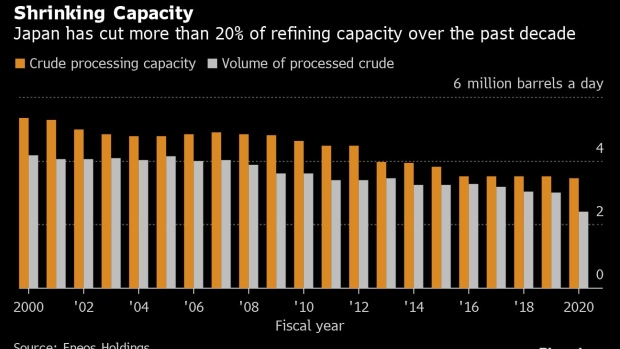

(Bloomberg) -- Japan’s biggest oil refiner is drawing up plans to consolidate production as domestic demand slumps because of a shrinking population and efforts to cut emissions.

Eneos Holdings Inc. has an outline for fusing operations but is still discussing which of its refineries to shutter when, President Takeshi Saito, who took over the helm of the Tokyo-based company in April, said in an interview. Eneos, which expects domestic fuel demand to slump 50% by 2040, has already announced a plan to close one of its 10 refineries next year.

The 60-year-old faces the same challenges of many of his peers around the world as efforts to reduce carbon-dioxide emissions target diesel and gasoline-powered transportation while electric vehicles become more mainstream. That is compounded in Japan by the effects of a shrinking population that further damps demand for fuels in the world’s third-largest economy.

“We’re keeping close watch on the pace of decline in demand,” said Saito. “We also need to consider the impact to the local municipalities, and decide how to use the refinery site -- whether it’s installing renewable energy, or using it as a logistics facility.”

Japanese demand for oil products is slated to drop 7.1% between fiscal 2021 and 2026, according to the trade ministry. Eneos, which supplies about half that need, in January said it would close its 127,500 barrel-a-day plant in Wakayama prefecture in October 2023.

Eneos seeks to achieve carbon neutrality by fiscal 2050 and last year agreed to buy a renewable energy company. It previously said that it planned to invest 400 billion yen ($2.8 billion) in renewable energy by the end of March 2023.

Related story: Energy Transition and Virus Claim Japanese Oil Refiner as Victim

The war in Ukraine has tightened global supply of oil products, and producers are maximizing capacity. Japanese refiners are increasing utilization rates on the back of strong export margins, and reopening after Covid lockdowns in the region could serve as a tailwind for the companies, Jefferies analyst Thanh Ha Pham said in a Sept. 7 note.

Nevertheless, Eneos needs to focus on domestic demand and the placement of its refineries in Japan rather than on investing in export infrastructure, Saito said.

“Idled refineries could start back up if the war in Ukraine ends or if China’s Covid Zero policy is tweaked,” he said. “That could alter the balance in the market.”

While a weak yen works in favor of the company’s oil and gas exploration and production and metals businesses, it weighs heavily on domestic prices and demand for oil products, Saito said. The government’s gasoline subsidy, which has been extended until year-end, helps to prop up some of the impact, he said.

©2022 Bloomberg L.P.