Apr 2, 2020

Larry Berman's Top Picks: April 2, 2020

By Larry Berman

MARKET OUTLOOK

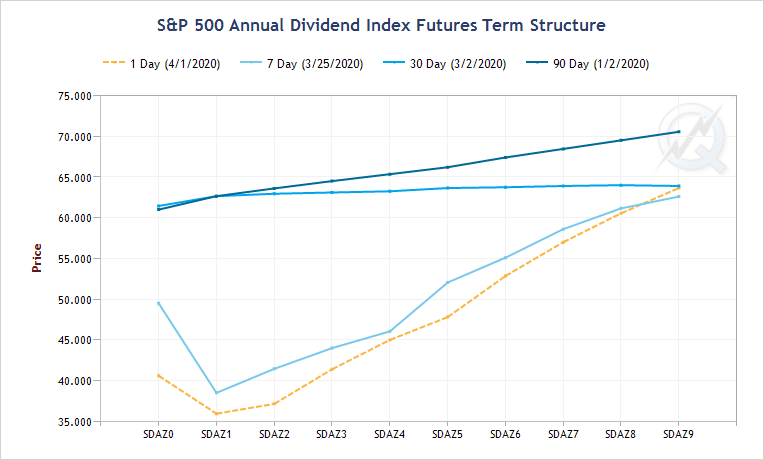

One of the market impacts from this crisis is a cut to dividends from companies looking to save cash or from legislation limiting dividends and share buybacks until government money is paid back.

The S&P 500 has futures contracts based on the expected dividend paid from the S&P companies. The contract price is the dollar amount of dividend. So a dividend of $62 on an index value of 3,100 is a 2 per cent yield. The expectations for dividend growth three months ago was for that to rise to over $70 by the end of the decade. Last month, that expectation was for no dividend growth. Today, we see a negative hit to dividends and it will not return to $61 until the end of the decade.

Dividends should still be a part of portfolios, but investors should consider this changing dynamic in the markets for the next decade and have this conversation with their financial advisors.

TOP PICKS

ISHARES MSCI INDIA ETF (INDA:UN)

ISHARES MSCI FRONTIER 100 ETF (FM:UN)

SPDR GOLD SHARES (GLD:UN)