Mar 15, 2022

Limit up or limit down? Nickel traders are bracing for wild ride

, Bloomberg News

LME Says Nickel Contracts Trading Will Resume on March 16

The world’s main nickel market reopens Wednesday, a week after the London Metal Exchange stepped in dramatically to defuse a runaway short squeeze. Most traders say they expect prices are more likely to drop than to spike again -- but either way, they’re getting ready for fireworks.

Nickel was suspended on March 8 after prices rose 250 per cent in little more than 24 hours, largely as metals tycoon Xiang Guangda struggled to pay massive margin calls to his banks and brokers. The squeeze -- and the LME’s unprecedented decision to cancel several hours’ worth of trades -- has roiled the global metals industry and sparked heated criticism of the exchange.

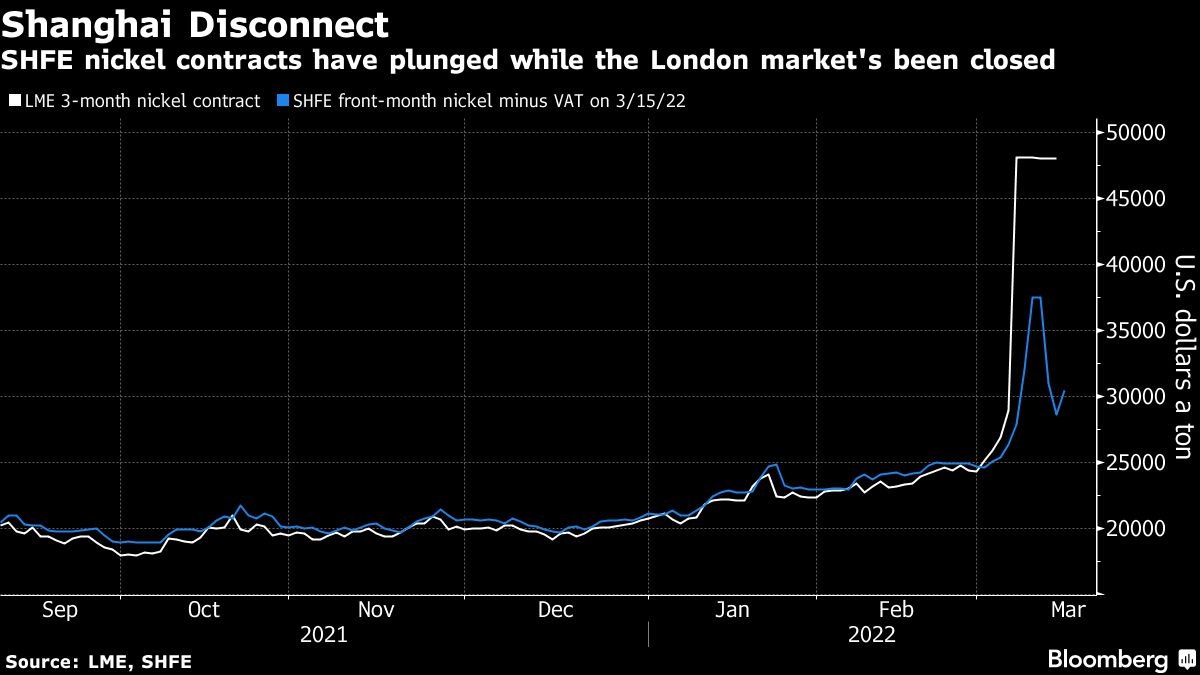

The market is opening after Xiang reached a deal with his banks to avoid further margin calls, reducing the risk that the squeeze is repeated. Nickel prices on the Shanghai Futures Exchange, the only real alternative to London, have dropped in the meanwhile, which could help take pressure out of the market when trading restarts.

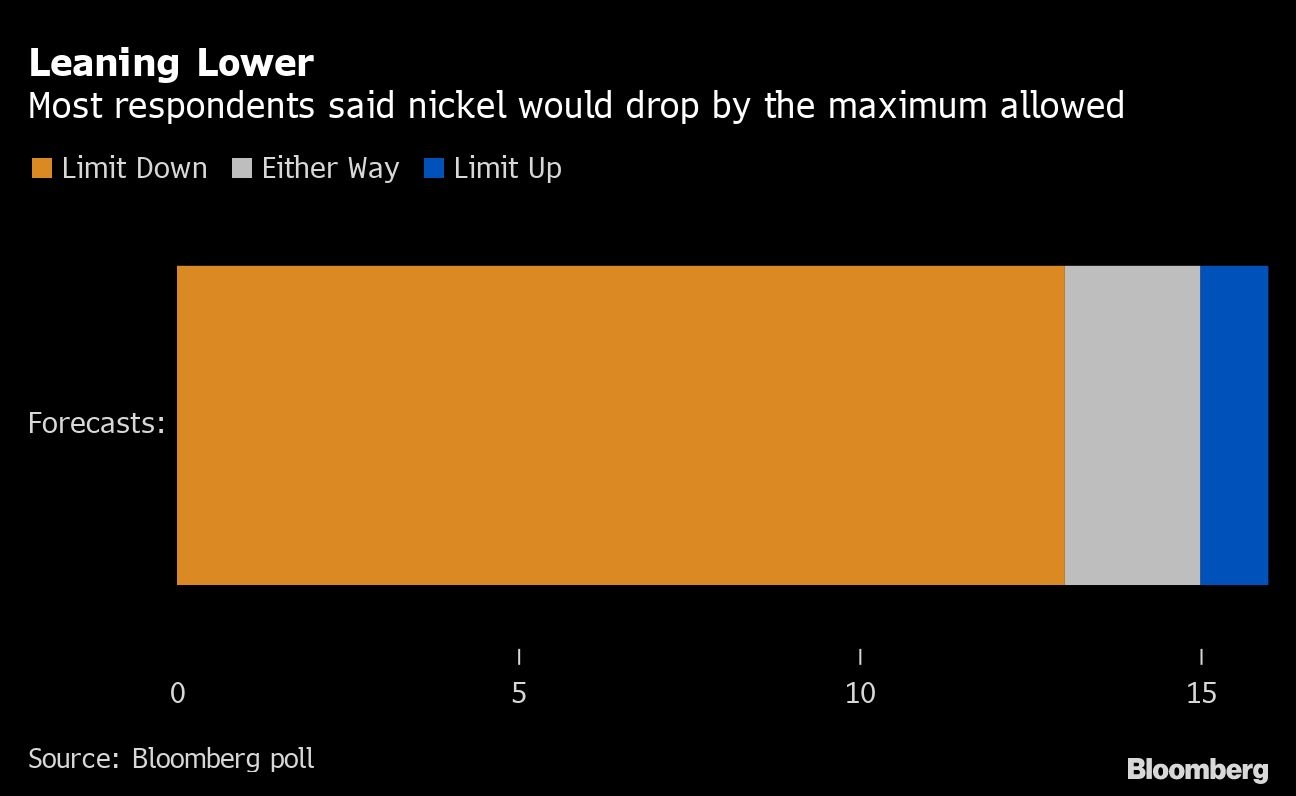

Out of 16 analysts and traders surveyed by Bloomberg, 13 predicted that nickel will drop by the new daily limit of 5 per cent that the LME announced this week to try and bring order to the market. One person said prices will go limit-up, while the other two said either scenario is possible.

“Whatever happens, I think it will be volatile,” Michael Widmer, head of metals research at Bank of America, said by phone from London. “It will probably go down, but there is still a residual bid in the market.”

Many regular market participants may be wary of diving in. Several brokers said they are reluctant to take on new short positions given the huge margin calls seen last week. Some hedge fund managers, including market veterans, have said they are either walking away from the LME or significantly reducing their trading.

To be sure, prices could rally again if Xiang’s Tsingshan Holding Group Co. moves to buy its short positions back quickly, or other bullish investors rush into the market.

However, a drop would track a sharp slump across financial markets during the contract’s week-long suspension. With risks to growth mounting globally, nickel contracts on the SHFE are about US$17,500 lower than the closing price of US$48,078 a ton seen on the LME last Monday.

If prices do fall, that would take considerable pressure off Tsingshan, which faced huge losses on its bearish bets as prices rocketed higher last week, creating what the LME has described as a systemic risk to its market.

A retreating market would probably reignite criticism from investors who made money in the market last week, only to have their trades canceled. Nickel hit an all-time high above US$100,000 a ton on March 8, and there’s been anger over the bourse’s decision to cancel the day’s trades, which were worth about US$3.9 billion.

More broadly, investors seeking to unwind positions in nickel will be forced to do so in an extremely volatile week for global markets.

A selloff across Chinese stocks deepened on Tuesday, with concerns about the nation’s ties to Russia and persistent regulatory pressure sending a key index to the lowest level since 2008. Brent crude plunged below US$100 a barrel, while other LME metals extended a sharp retreat.

“We’ve had broad-based risk-off moves across commodities and other asset classes including equities, so if nickel follows that momentum then we could see lower prices,” Xiao Fu, head of commodities strategy at BOCI Global Commodities, said by phone from London. “Most market participants expect prices to move lower, but it’s just a question of how long it will take for the market to rebalance.”