Sep 25, 2023

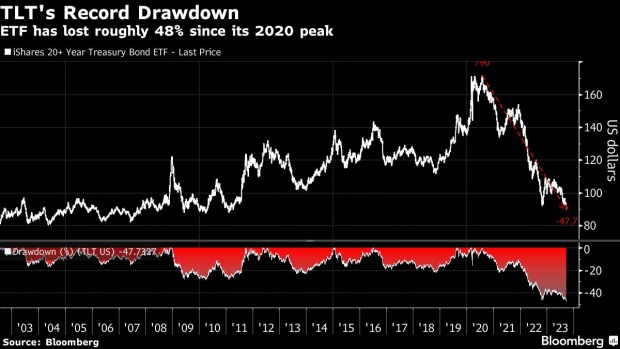

Long-Treasury ETF Plunges Record 48% as Market Meltdown Worsens

, Bloomberg News

(Bloomberg) -- The largest long-dated bond ETF is suffering its biggest drawdown on record as the Federal Reserve’s higher-for-longer interest rates start to sting.

The $39 billion iShares 20+ Year Treasury Bond ETF (ticker TLT) has lost 48% from its 2020 all-time high and is trading at its lowest point since 2011, according to data compiled by Bloomberg. At the same time, IHS Markit Ltd. data show that bets against the fund have risen, with short interest as a percentage of its shares outstanding at its highest in about a month.

“It’s all about interest-rate expectations — inflation ignited a major move higher, and that along with a stronger-than-expected economy means rates continue to trend higher,” said Todd Sohn, ETF and technical strategist at Strategas Securities. “There’s also the possibility of further hikes, so that hurts anything with any duration on it.”

Investors have been adjusting to the reality of what the Fed has been messaging for a while: that rates will stay higher for longer.

The central bank reiterated last week that it sees borrowing costs remaining high next year, given the strength of the US economy. In projections, 12 out of 19 officials signaled that they see yet another rate hike this year and forecast fewer cuts than had been previously anticipated. In this environment, yields on long-dated US debt have gone sharply higher — the 30-year yield on Monday rose as much as 12 basis points to 4.64%, a level not seen since April 2011.

Read more: Treasuries Extend Selloff, Pushing 10-Year Yield to 16-Year High

To Zachary Griffiths at Creditsights, the big upward move in long-term Treasury yields can be tied back to early August, when Fitch Ratings downgraded the US credit rating and the Bank of Japan unexpectedly tweaked its policy. These and other factors pushed real yields higher.

“More recently we think the additional selloff came from the September FOMC meeting decision in which policymakers indicated they expected economic growth to be even higher in 2023 (2.1% vs 1.0% in the June SEP) and rates to remain higher for longer,” said Griffiths, a senior fixed-income strategist. “Rates markets are pricing in fewer rate cuts over the next couple of years on the back of this move which has pushed yields across the curve higher, not just at the very front end.”

Read more: Cross-Asset Selloff Snowballs as Traders Adjust to Fed’s Reality

TLT has dropped roughly 10% so far this year, which follows a 33% plunge last year and a 6% drop in 2021. Other long-duration funds have also suffered, with the Vanguard Extended Duration Treasury ETF (EDV) down 14% in 2023, and the PIMCO 25+ Year Zero Coupon US Treasury Index (ZROZ) off by more than 15%.

“The trend in bonds is firmly lower,” Jonathan Krinsky, chief market technician at BTIG, wrote in a note last week. “At some point we continue to expect long rates to head lower as the effects of ‘higher for longer’ take their toll on the economy. At that point we would expect rates down with stocks down, something we haven’t seen much of this year.”

--With assistance from Katie Greifeld, James Seyffart and Michael Mackenzie.

©2023 Bloomberg L.P.