Jun 28, 2023

Micron Delivers Strong Forecast in Sign That Glut Is Easing

, Bloomberg News

(Bloomberg) -- Micron Technology Inc., the largest US memory-chip maker, slid Thursday on concern that it faces a slow recovery from an inventory glut that has ravaged its finances.

When the company reported quarterly results Wednesday, it signaled that the personal computer market remains challenging — and a probe in China is threatening a large portion of sales. After gaining in early trading, the shares declined as much as 5.2% to $63.55.

Though Micron’s customers are working through a pile of excess inventory, the company isn’t predicting a rapid return to growth in 2023. PC shipments are expected to decline by a “low double-digit” percentage from a year ago, slumping to a level that’s below where that market was before the pandemic. The smartphone industry will contract by a percentage in the mid-single digits from a year ago, Micron predicted.

On the plus side, Micron said it has passed the low point of the current downturn.

Micron has no plans to write down any more inventory — something that’s weighed heavily on its profitability — in the current quarter, according to Manish Bhatia, an executive vice president and head of global operations.

“The worst is behind us — the revenue trough is behind the industry,” he said in an interview. “It’s really about the rate and pace of the recovery now.”

But the situation in China — where the government has decided that Micron’s products are a security risk — remains a major cloud. Chief Executive Officer Sanjay Mehrotra called it “a significant headwind that is impacting our outlook and slowing our recovery.”

Read More: What Wall Street Is Saying About Micron’s Prospects

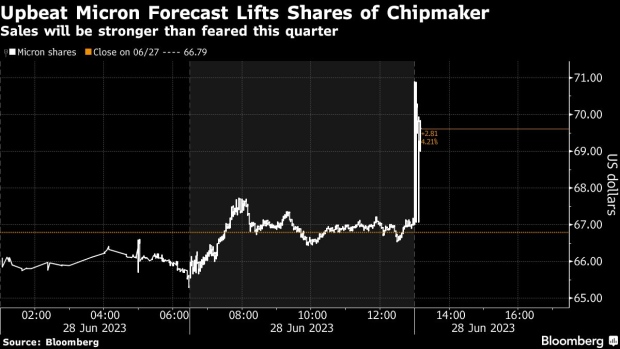

Micron is projecting a loss of about $1.12 to $1.26 a share in the fiscal fourth quarter, worse than the estimated $1.10 loss. Sales will be as much as $4.1 billion in the period, compared with an average analyst estimate of $3.87 billion.

In the three months ended June 1, Micron’s revenue declined 57% to $3.75 billion. The company had a loss of $1.43 a share, excluding certain items. That compares with an average estimate of a loss of $1.59 a share and sales of $3.69 billion.

Like many of its peers, Micron has suffered a collapse in orders for its products after sluggish demand for smartphones and personal computers led to a buildup of inventory. But investors have been betting on a comeback. The shares had gained 34% this year before Thursday.

Micron’s chips, which help store and handle information, are particularly vulnerable to swings in demand because memory products are directly interchangeable and traded like commodities.

Rapid fluctuations in the balance between supply and demand can leave producers selling the components for less than they cost to make. Micron is also up against formidable rivals in South Korea: Samsung Electronics Co. and SK Hynix Inc.

Prior to disruptions caused by the pandemic, Micron’s management had argued that the spread of memory chips to more markets would help prevent another boom-and-bust cycle. And even now, Mehrotra and his team maintain that once this current set of unusual circumstances is over – the global pandemic, a war in Europe and supply chain disruptions — the industry will return to long-term profitable growth.

But unlike its Korean competitors, Micron has also fallen prey to the geopolitical rivalry between China and the US. The Cybersecurity Administration of China has probed the company and barred its chips from critical infrastructure.

The Boise, Idaho-based company has warned that about half of its sales tied to China-headquartered clients may be affected by the probe. That represents a “low-double-digit percentage” of its global revenue.

Mehrotra said on a conference call with analysts the situation in China remains “uncertain and fluid.”

“Micron is working to mitigate this impact over time and expects increased quarter-to-quarter revenue variability,” he said. The company’s “long-term goal” is to retain its global market share, Mehrotra said.

Several of Micron’s customers are being contacted by officials as part of the China investigation, which was announced earlier this year. Micron’s revenue with businesses based in mainland China and Hong Kong, including direct sales as well as indirect sales through distributors, accounts for about a quarter of the company’s total.

©2023 Bloomberg L.P.