Jul 7, 2023

Oil heads for second weekly climb after OPEC+ leaders wade in

, Bloomberg News

Based on insider buying signals, natural gas stocks might have an even better H2 than H1: Researcher

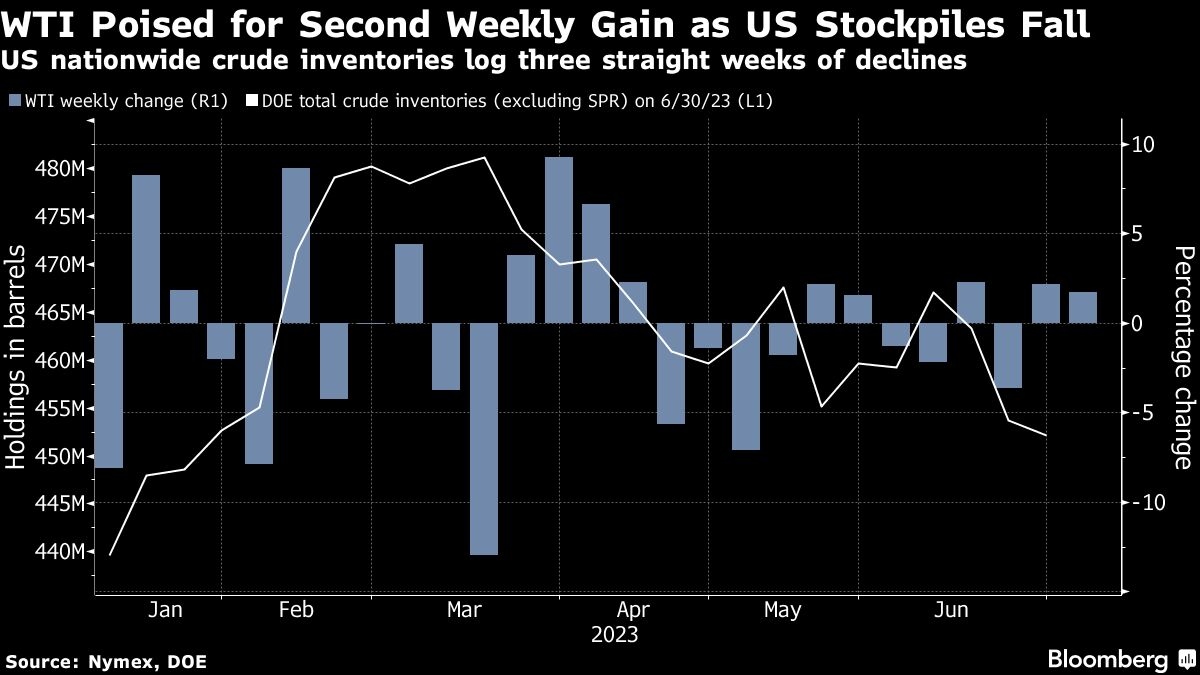

Oil headed for a second weekly gain after OPEC+ leaders Saudi Arabia and Russia tightened supplies and U.S. crude stockpiles fell.

West Texas Intermediate was little changed near US$72 a barrel, on course for a weekly advance of 1.6 per cent. The U.S. crude benchmark is set for the first back-to-back weekly increase since May, with near-term time spreads flipping into a narrow backwardated structure, a bullish pricing pattern.

Saudi Arabia set large price increases for its crude to Europe and the Mediterranean after announcing an extension into August of its unilateral one-million-barrel-a-day supply cut. In addition, Russia said it would reduce exports by half a million barrels, although output won't be lowered.

Crude remains down about 10 per cent this year, with tighter monetary policy, China's lackluster recovery, and resilient Russian exports pressuring futures. This week's price rise came despite a broad move lower in other risk assets as robust U.S. jobs data reinforced bets the Federal Reserve will keep hiking interest rates.

“We remain cautiously bullish,” said Keshav Lohiya, founder of consultant Oilytics. “We think backwardation is here to stay and any major dips in crude structure should be bought. OPEC might have little control on flat price, but they will have control on the curve structure.”

Prices:

- WTI for August delivery was little changed at US$71.76 a barrel at 9:58 a.m. in London.

- Brent for September settlement was also steady at US$76.45 a barrel.