Nov 5, 2021

Protests Begin as First Week of Talks Wrap Up: COP26 Update

, Bloomberg News

(Bloomberg) -- Thousands of demonstrators are set to march in Glasgow, Scotland, over the next few days, as the COP26 climate summit wraps up its first week. They’re protesting government inaction, lack of access to conference events and what activist Greta Thunberg has described as “greenwashing.”

There’s been some progress so far -- including deals on phasing out methane, coal and fossil fuel funding -- but they’re not backed by some of the world’s largest polluters, and a closer look reveals some important exceptions and loopholes. Much work also remains on establishing international carbon markets.

The talks, set to run through Nov. 12, are expected to become more intense next week -- and get deeper into the nitty gritty. It’s already looking thorny, but summit President Alok Sharma has a new goal: break a COP tradition and finish on time next Friday.

Key developments:

- Protests kick off around Glasgow, to culminate over weekend

- Carbon markets stumble on use of cash

- Indonesia says billions needed to shut coal plants earlier

(All timestamps Glasgow, Scotland)

Protest Day (11:20 a.m.)

Protests are starting to kick off around Glasgow, with school children in small groups waving banners and calling for action. Along the River Clyde, groups of campaigners are marching, and the police presence seems to have been beefed up. At least for now, it’s all pretty polite.

Indonesia Says $48 Billion Needed to Shut Coal Plants Earlier (10:13 a.m.)

Indonesia, the world’s largest exporter of thermal coal, can shut coal plants emitting 89 million tons of carbon dioxide earlier with $48 billion of investment.

Southeast Asia’s largest economy can retire 9.2 gigawatts of coal power plants before 2030 with investments in renewable energy projects, Arifin Tasrif, the energy and mineral resources minister, said in a statement. Without the funds, Indonesia plans its first phase coal plants retirement in 2031 and its last coal plant in 2055 instead.

Indonesia is among the countries that have signed a pledge to transition away from coal, while stopping short at agreeing to halt construction of new plants.

Heineken CEO Wants More Government Action on Climate (10:06 a.m.)

Heineken wants governments to do more to address climate change, Chief Executive Officer Dolf van den Brink said, adding that some businesses are already moving faster than lawmakers on the issue.

In an interview with Bloomberg Television, the CEO said he’s leaving COP26 “partly worried about the political process,” but hopeful about public-private partnerships.

Carbon Market Proposals Show Much Work Remains (9:20 a.m.)

New draft proposals on international carbon markets showed countries are still far apart on how to use the revenues generated by carbon trading. They also differ on issues such as accounting and the use of credits from the now-defunct Clean Development Mechanism, the previous United Nations emissions-reduction program.

While the 2015 Paris Agreement’s Article 6 paved the way for the use of markets in the fight against climate change, their launch requires a set of detailed, technical provisions in order to function.

Talks will move to a higher level next week, when ministers are scheduled to arrive in Glasgow. Heated negotiations are expected to continue until the last day of COP26, due to end Nov. 12. Previous conferences have often run a day or two longer than planned.

Banks Are Seen Needing More Oversight on Climate (9:00 a.m.)

While the pledges made by global financial firms to target net-zero emissions are welcome, they’ll require more clarity and consistency to ensure that goal is actually reached, according to Cynthia Cummis, director of private sector climate mitigation at the World Resources Institute.

“One important metric to look at is what is the rate of finance invested in fossil fuels versus the capital flows going to climate finance,” she said in an interview with Bloomberg Television’s Maria Tadeo. “If you look now, the rate of finance going into fossil fuels is more than twice as large as the capital going into climate finance.”

Separately, ShareAction CEO Catherine Howarth said the Glasgow Financial Alliance for Net Zero appears to set inconsistent standards for asset managers and banks -- with the former facing a higher bar. Too many GFANZ members from the banking sector continue to provide finance to new fossil fuel projects, she added, also in an interview with Bloomberg Television.

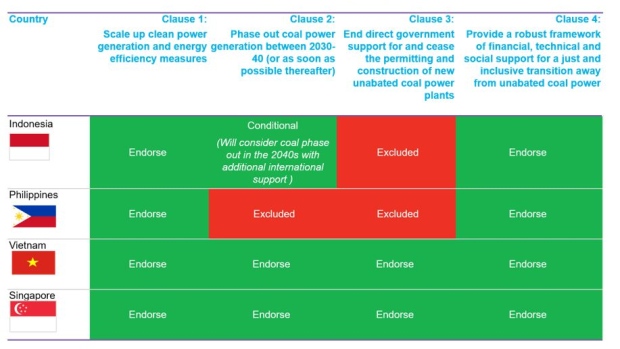

Southeast Asia Coal Phaseout Pledges Aren’t Equal: BNEF (5:35 a.m.)

Indonesia, the Philippines, Vietnam and Singapore joined over 40 other countries in a pledge to wean off coal power generation, but the extent of their commitment differs, according to BloombergNEF.

Vietnam is the most aggressive through its commitment to all clauses under the pledge given the 20.4 gigawatts of coal power plants it currently has. In a confusing move, Indonesia and the Philippines held back from committing to end direct government support and to cease the construction of new coal power projects despite both countries introducing a moratorium on new coal power projects earlier. Both countries also stopped short of agreeing to phase out coal power generation.

Just Catching Up on COP26?

Thursday was Energy Day at the conference. Here’s a quick recap.

©2021 Bloomberg L.P.