Apr 25, 2023

Quants Are ‘Out of Ammo’ for Buying Stocks, Goldman Warns

, Bloomberg News

(Bloomberg) -- Amid resurgent banking angst, rattled stock markets may have to live without a key source of buying power.

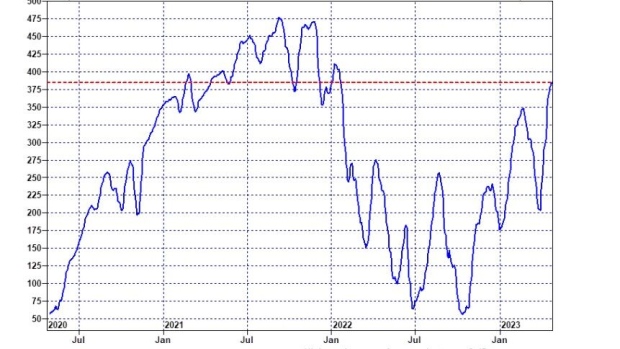

That’s the warning from Goldman Sachs Group Inc.’s Scott Rubner, whose data show systematic money managers have loaded up on more than $170 billion worth of global shares in the past month, driving the funds’ exposure to the highest level since early 2022.

Now, with their positioning near a peak, the group is more inclined to be sellers in coming weeks, according to the market veteran, who has studied flow of funds for two decades.

Trigger signals for commodity trading advisers — CTAs that surf the momentum of asset prices through long and short bets in the futures market — sit at levels including 4,130 on S&P 500, his model shows. The index dropped 65 points to 4,071.63 Tuesday.

“I am tactically bearish,” Rubner wrote in a note to clients Tuesday afternoon. “The buyers are out of ammo.”

From trend followers to traders who allocate assets based on volatility signals, quant funds would be forced to unwind as much as $276 billion of shares should the market sell off in the next month, according to Goldman’s model. However, thanks to their elevated exposure, they would only need to purchase up to $25 billion if a big rally takes hold during the same time frame.

That’s potentially bad news for stock bulls who just got hit with the worst day for the S&P 500 in over a month after gloomy news from First Republic Bank rekindled worries that the lending crisis has not run its course. If sustained, the unwinding from quants has the potential to create additional pressure for a market where caution prevails amid recession concerns and a looming deadline for US government debt ceiling.

Flow analysis has gained traction in the past year as investors struggled to get a firm grip on the path of the economy and monetary policy. At the end of March, when Wall Street strategists were trying to figure out what the bank crisis would mean for US stocks, Rubner said stocks would head for more gains in April, citing defensive positioning among investors.

To be sure, big systemic traders are only one force in the market, albeit a large one. Tracking and predicting their impact on supply and demand dynamics is fertile ground for Wall Street analysis but is by its nature an imprecise science.

Read more: Goldman’s Rubner Sees Stocks Primed for Further Gains in April

Before the 1.6% drop Tuesday, the S&P 500 had not incurred a loss of more than 1% in April and was poised for a small gain in the month. Trapped in 2.5% band since the first quarter ended, the equity gauge is heading for the smallest monthly move since June 2017.

In part lured by the eerie calm sweeping stocks of late, quant funds spent the past month scooping up equities, acting as a main source of support for the market.

A turn in their behavior would weigh on the market, vindicating those who warned the recent tranquility has masked dangers beneath the surface. Earlier this week, JPMorgan Chase & Co.’s top-ranked strategist, Marko Kolanovic, said the peace was driven by technical forces such as options sellers fueling intraday turnarounds that left the market largely unchanged on most sessions.

Read more: JPMorgan’s Kolanovic Says Low Equity Volatility Masks Risks (1)

©2023 Bloomberg L.P.