Mar 23, 2022

Russian Stock Trading to Resume After Record Market Shutdown

, Bloomberg News

(Bloomberg) -- Russia will restart trading in some local equities, ending the nation’s record long shutdown that was meant to shield domestic investors from the impact of tough sanctions over its invasion of Ukraine.

The Moscow Exchange will resume trading in 33 Russian equities, including some of the biggest companies such as Gazprom PJSC and Sberbank PJSC, on March 24 between 9:50 a.m. and 2 p.m. local time, the Bank of Russia said in a statement. A ban on short selling will apply, it said. Local stock trading has been halted from Feb. 28, marking the longest closure in the country’s modern history.

Read More: Lessons for Russia From Long Stock Market Shutdowns: QuickTake

Even with the ban on short selling, local traders and strategists are bracing for a selloff, as international sanctions hit everything from Russia’s ability to access foreign reserves to the SWIFT bank-messaging system. The MOEX Russia Index slumped as much as 45%, the most on record, on the day the invasion started. The ruble is the world’s worst performer this year, although it has edged higher over the past week as peace negotiations continued between Russia and Ukraine.

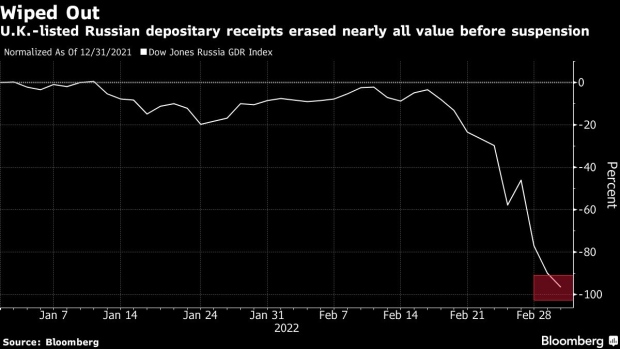

In a sign of what might happen when local stocks trading reopens, European companies with business exposure to the country have lost more than $100 billion in market value since the war risks surged, Russian companies’ global depositary receipts slumped more than 95% before being halted and global index providers removed Russian shares from their indexes.

Cristian Maggio, head of portfolio strategy at TD Securities in London, said trading had been suspended for this long to avoid panic selling and a crash in valuations. “When trading resumes, we may see extremely shallow volumes, but it may happen that stocks rebound, possibly even lifted by government-sponsored purchases,” he said.

To shield the nation’s economy and markets from steep losses, the Bank of Russia banned brokers from selling securities held by foreigners on the Moscow Exchange. On Tuesday, the bourse banned short selling in some of Russia’s biggest companies. Russia plans to deploy up to $10 billion from its sovereign wealth fund to buy up battered local stocks.

©2022 Bloomberg L.P.