Nov 14, 2022

Seven Charts Show State of Malaysia’s Economy Ahead of Polls

, Bloomberg News

(Bloomberg) -- As Malaysians head to the polls on Nov. 19, rising costs of living and a weaker currency will likely influence how they cast their ballots.

Latest indicators show mixed results. Gross domestic product logged a region-beating double-digit growth in the third quarter and labor force has shown flashes of returning to pre-Covid levels, even as key sectors including palm oil and manufacturing continue to face worker shortages.

Here’s where the economy stands prior to the national vote.

Malaysia expanded at 14.2% in the July-September period, a blowout number even with a low base in a Covid-addled 2021. Sustained strong demand for services and manufactured goods is likely to keep the economy clear of a recession next year, a view echoed by Bank Negara Malaysia Governor Nor Shamsiah Mohd Yunus.

Still, the rapid, but uneven rebound from the pandemic may have bypassed some key electorate bases, as seen in the labor data.

Malaysia’s overall jobless rate returned to a near pre-pandemic level of 3.7% in September, with levels varying with ethnicity.

Malays, the largest ethnic group, trailed other blocs with an unemployment rate of 4.1%. In comparison, Indians had an unemployment rate of 2.8%, while ethnic Chinese posted the lowest jobless rate of all groups at 2.7%.

Peninsular Malaysia, home to the capital city of Kuala Lumpur and Penang, may be the pageant winner for economic performance, but the eastern states of Sabah and Sarawak that jointly account for a quarter of parliament seats hold the swing blocs key to forming the next government.

Sabah saw its jobless rate fall to 8.2% in the third quarter, but remains well behind its pre-Covid peak of 5.3%. Meanwhile, Sarawak had improved to a 3% jobless rate. Female unemployment reached its lowest in 10 quarters at the end of September at 3.9%, while that for male workers was at 3.6%. The rate of youth out of jobs was high at 10.8% in the 15 to 24 age group.

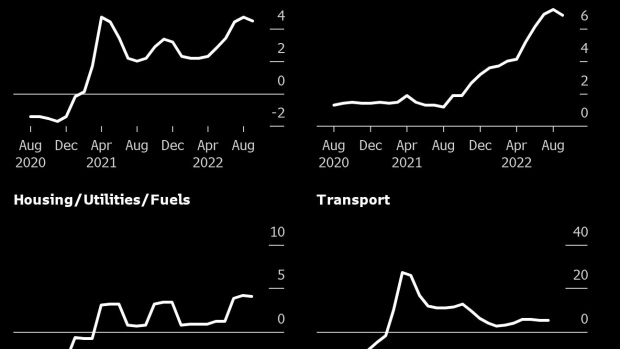

Like elsewhere, Malaysia’s 32.8 million people are struggling with rising costs of living as inflation has doubled from the start of the year despite food and fuel subsidies. Core inflation, which excludes volatile items like fresh foods, touched a seven-year high of 4% in September.

The cost for food reached a decade-high of 7.2% in August, with meat and dairy prices burning a hole in the pockets of consumers. Though Governor Shamsiah said that the overall inflation had likely peaked at 4.5% in the third quarter, voters expect the next government to retain price controls.

A weak ringgit has bloated Malaysia’s food-import bill, worsening price pressures in a nation that relies on overseas purchases to meet more than half its food needs. The dollar strengthened against the nation’s currency in 2022, rising to 4.5925 from 4.1615 in the latest year-over-year reading. On the flip side, a weak ringgit, rising commodity prices and surging manufacturing sector boosted exports to a record 146 billion in June.

While imports have grown at a higher rate than exports through September in 2022, there’s little reason for alarm given the trade balance is in surplus.

Keeping in step with other central banks fighting inflation, Bank Negara Malaysia hiked borrowing costs for four straight sessions this year. Bloomberg Economics expects another rate increase at BNM’s next meeting in January amid the continued increase in core inflation.

©2022 Bloomberg L.P.