Jun 19, 2019

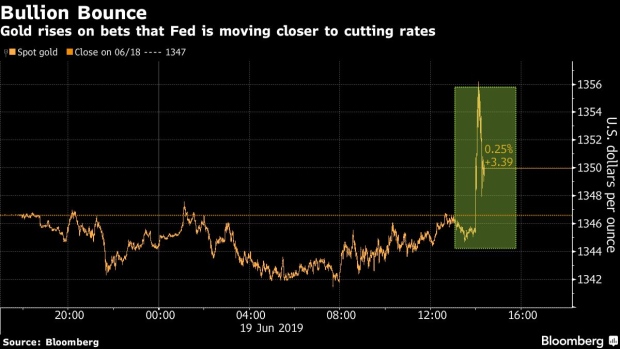

Spot Gold Jumps as Fed Seen Moving Closer to Cutting U.S. Rates

, Bloomberg News

(Bloomberg) -- Spot gold climbed after the Federal Reserve signaled a readiness to cut U.S. interest rates, citing increased economic uncertainties.

While policy makers left their key rate unchanged on Wednesday, they dropped a reference in their statement to being “patient” on borrowing costs and forecast a larger miss of their 2% inflation target this year.

Gold has posted four straight weekly gains, partly on bets that the Fed will lower interest rates amid signs that escalating trade disputes are affecting the U.S. economy. Low rates are a boon to precious metals, which don’t offer yields.

“Even though the Fed didn’t cut rates, the market expectation for a dovish environment and a likely rate cut in July are positive for gold,” Maxwell Gold, the New York-based director of investment strategy at Aberdeen Standard Investments, said by email. “As concerns around slowing global growth and trade put further pressure on monetary policy globally gold may see further support.”

Bullion for immediate delivery rose 0.6% to $1,354.78 an ounce at 2:10 p.m. in New York.

To contact the reporters on this story: Joe Richter in New York at jrichter1@bloomberg.net;Marvin G. Perez in New York at mperez71@bloomberg.net

To contact the editors responsible for this story: Luzi Ann Javier at ljavier@bloomberg.net, Joe Richter

©2019 Bloomberg L.P.