Feb 20, 2020

T-Mobile, Sprint renew deal as merger clears regulatory hurdles

, Bloomberg News

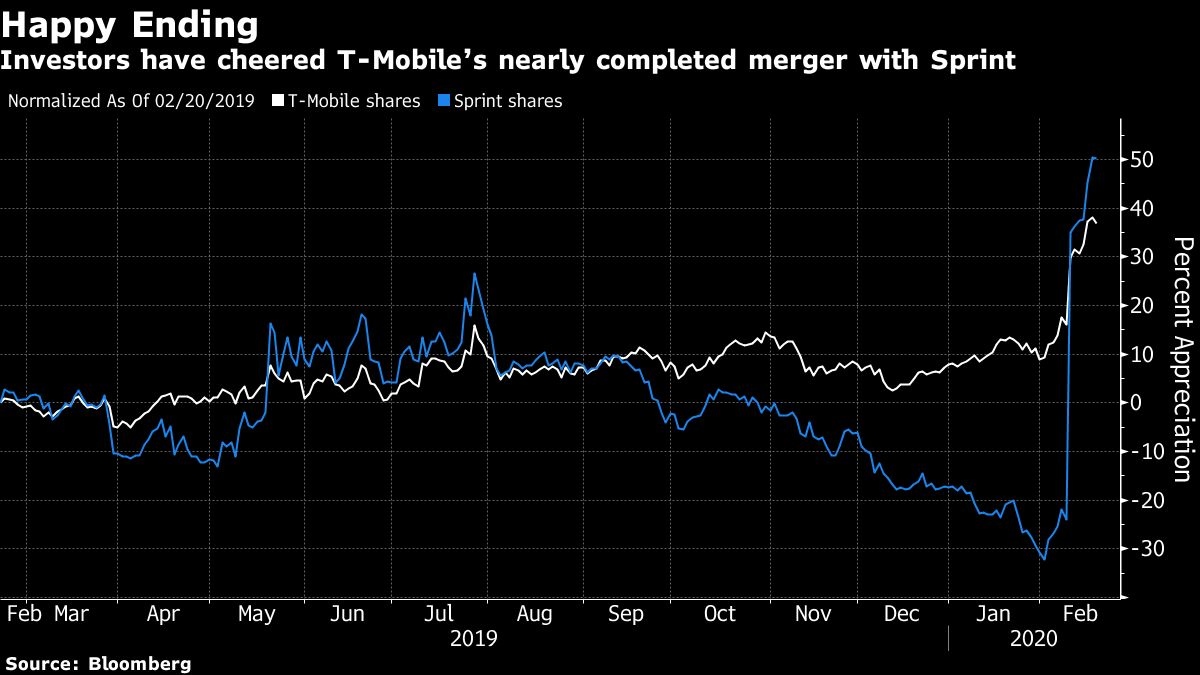

T-Mobile US Inc. and Sprint Corp. agreed to new terms for their pending merger, a key step to completing a transaction that has now cleared most regulatory hurdles.

Under an agreement announced Thursday, T-Mobile owners will get roughly 11 shares of Sprint for each of their shares. That’s an increase from a ratio of 9.75 previously -- and a more favorable deal for T-Mobile parent Deutsche Telekom AG.

SoftBank Group Corp., Sprint’s majority owner, agreed to surrender 48.8 million T-Mobile shares that it will acquire in the merger to the combined company immediately after the transaction closes. But those shares could be reissued to SoftBank by 2025 if the new company’s stock stays above $150 for a period of time.

Sprint investors other than SoftBank will still get the original ratio of 0.10256 T-Mobile shares for each Sprint share -- the equivalent of about 9.75 Sprint shares for each T-Mobile share.

When the transaction closes, which could happen as soon as April 1, Deutsche Telekom is expected to keep 43% of the merged entity, while SoftBank has 24%. The rest will be held by public shareholders.

The original accord, which united the third- and fourth-largest U.S. wireless carriers in a US$26.5 billion deal, was forged in April 2018. That pact lapsed on Nov. 1, and the companies didn’t initially renew the terms while they fought for government approval. When a federal judge rejected a state lawsuit to block the transaction earlier this month, that put the talks on the front burner.

Along the way, Sprint’s condition has worsened. That added pressure to redraw the agreement so that it was more favorable to Deutsche Telecom.

Sprint’s monthly churn -- a closely watched measure of how many customers leave -- has risen to nearly 2%. That means roughly a quarter of its subscriber base is quitting the carrier each year. And the company isn’t making up for the decline by charging more: Average revenue per customer has fallen 5% since the deal was announced.

Analysts such as LightShed Partners’ Walt Piecyk said the merger’s exchange ratio should be closer to 12, given Sprint’s deteriorated business.