Nov 11, 2022

Tenreyro Says BOE May Need to Cut Rates From Next Year

, Bloomberg News

(Bloomberg) --

The Bank of England may need to cut interest rates next year and to under 2% in 2024 to prevent inflation falling well below target in a widely-expected recession, according to the most dovish member of the Monetary Policy Committee.

Silvana Tenreyro, an external MPC member who was alone in voting for a quarter-point hike at last week’s meeting, said policy was already restrictive with rates at 2.25%.

Seven of the nine MPC members voted to raise rates by three quarters of a percent to 3% last Thursday. The other dissenter voted for a half-point rise.

Tenreyro said recent data showed the economy is weakening, with official figures on Friday revealing GDP contracted 0.2% in the third quarter. In her central case, she would hold rates at 3% in 2023 and start cutting in 2024. But if the UK falls into a deep recession, rate cuts may be needed next year.

The bank is having to tread a difficult line between tackling inflation, which at 10.1% is five times its target level, and squeezing so hard it induces a worse recession.

Last week, the BOE warned that the UK would fall into a yearlong contraction with rates at 3%, costing 500,000 jobs. It’s forecasts showed the UK is already in recession.

“These forecasts suggested to me that policy was already in restrictive territory ahead of our November meeting. And given policy lags, it had probably been restrictive for some time before,” Tenreyro said at the Society of Professional Economists’ annual conference in London.

She said she had been reluctant to raise rates even by a quarter point but decided to do so for “risk management” reasons – “to guard against the risk that inflation does not fall as far or as quickly as I expect.”

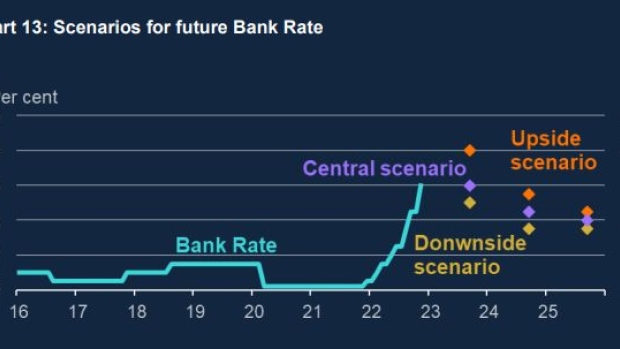

In an echo of the “dot plots” used by US Federal Reserve policymakers to map out the rate path they believe is needed to bring inflation back to target, Tenreyro set out three scenarios for bank rate.

If wages and prices continue to spiral up, she would raise rates to 4% next year and cut them just below 3% in 2024 and to 2% in 2025. Her central scenario would see rates remain at 3% through 2023 before dropping to just above 2% in 2024 and 2% in 2025.

If the economic shock is more damaging to the labor market, her worst-case scenario, she would cut rates to 2.5% in 2023, below 2% in 2024 and then left them almost to 2% in 2025.

Her decision to use a form of “dot plots” was unusual. Ben Broadbent, the deputy governor for monetary policy, used a similar “optimal” path for rates in a recent speech. The BOE has previously chosen not to use dot plots to signal the likely rate path to markets.

The market path remain much higher.

©2022 Bloomberg L.P.