Feb 22, 2024

Thai Potash Mine Owner ITD Weighing $500 Million Stake Sale, Sources Say

, Bloomberg News

(Bloomberg) -- Italian-Thai Development Pcl is considering selling its 90% stake in Asia Pacific Potash Corp., which has mining rights in Thailand, and is seeking about $500 million, according to people familiar with the matter.

The Bangkok-based construction company is working with an adviser and talking with potential buyers, including from China, one of the people said.

Talks with potential interested parties are ongoing and may not lead to a deal, the people said, asking not to be identified discussing confidential information.

Asia Pacific Potash referred queries from Bloomberg News to ITD, which didn’t respond to a request for comment.

ITD, one of Thailand’s biggest construction firms, acquired Asia Pacific Potash in 2006. The company has exploration and development rights to high-grade potash deposits in the northeastern Thai province Udon Thani.

Asia Pacific Potash applied to the government for rights to the 10,500-acre site in 2003, but it took until 2022 for it to receive official approval to operate the project for 21 years, according to the company’s website. It has annual capacity of 2 million tons of potash, the company said.

Thai Prime Minister Srettha Thavisin inspected the main mine on Feb. 19, according to a government statement. He asked about the source of funds for the project and also met citizens opposed to the potash mine, it said.

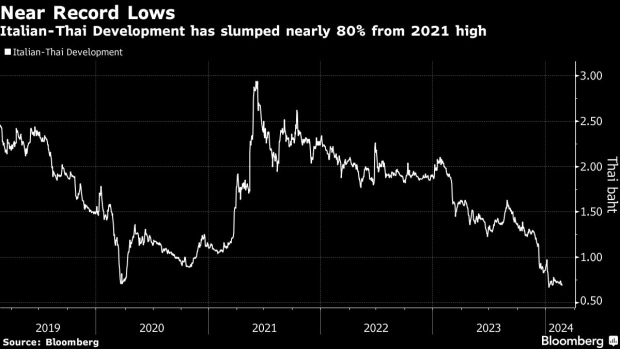

ITD’s market value has shrunk since reaching around $3 billion in the 1990s, falling to $100 million now. The company, which was founded in 1954, reported a net loss of 44.7 million baht ($1.2 million) in the third quarter of 2023 and a 4.76 billion baht loss for full-year 2022.

The company’s president and biggest shareholder, Premchai Karnasuta, was released from prison on parole last year after being sentenced for wildlife poaching, including, according to the Bangkok Post, a rare black panther.

Krungthep Turakij newspaper reported in January that ITD planned to delay payment of 2 billion baht in bonds due the following month. Bondholders later agreed to approve extending redemption dates for two years.

©2024 Bloomberg L.P.