Jun 12, 2018

The US$1.4 trillion 'surplus' that Trump's not talking about

Bloomberg News

The U.S. has a surplus of US$20 billion with China and US$1.4 trillion with the rest of the world.

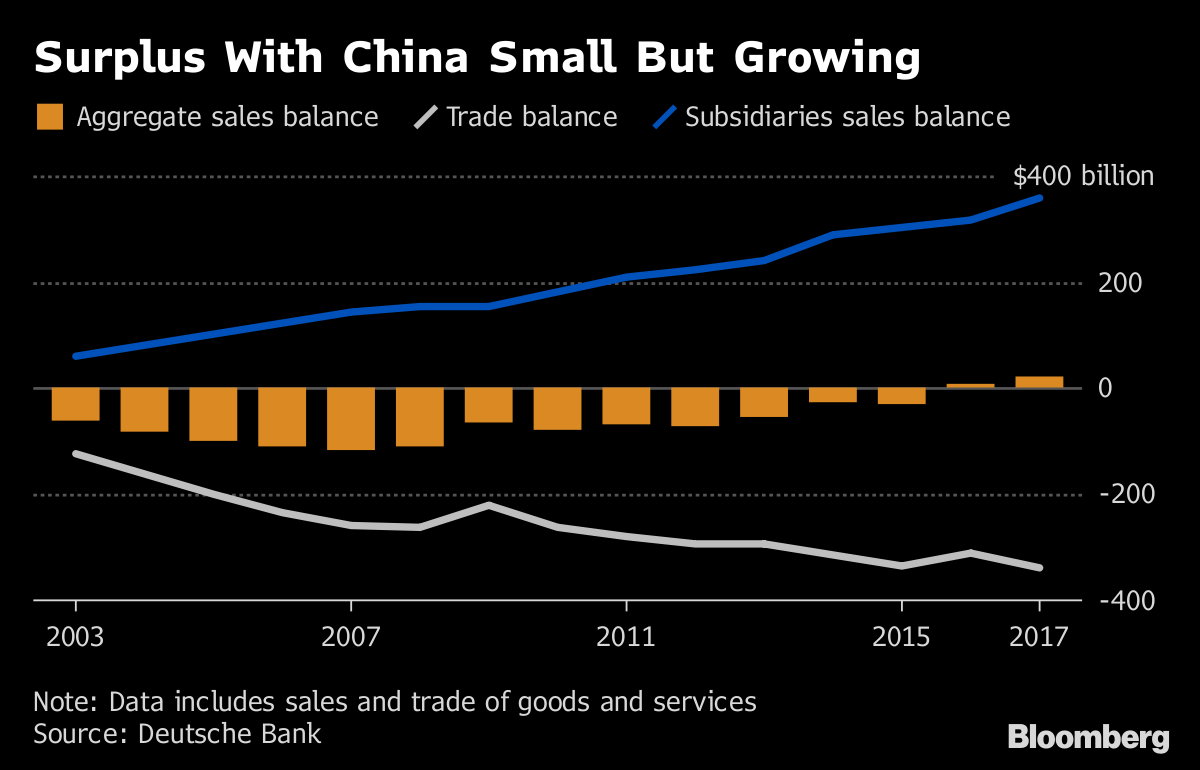

That’s not a normal trade balance, of course, where the U.S. registered an annual deficit of more than US$330 billion with China and about US$550 billion with the world last year, but an "aggregate sales surplus" which measures both direct trade and the sales of multinational companies, according to research by Deutsche Bank AG.

Just looking at the goods and services trade deficit is misleading and doesn’t capture the true size of U.S. business interests, according to Deutsche Bank economists. While trade and corporate data aren’t usually combined, if you add up all trade data, sales by U.S. companies in foreign countries and foreign firms in the U.S., "U.S. companies have sold more to the rest of the world than other countries have sold to the U.S. in the past ten years," Zhang writes.

President Donald Trump’s determination to rein in his nation’s trade deficit has put him at odds with the developed world, a stance that undermined an acrimonious G7 summit in Canada at the weekend. China and the U.S. are meanwhile locked in negotiations to stave off a trade war, with Trump threatening to slap tariffs on at least US$50 billion in Chinese imports after June 15.

For China, the image of a massive trade deficit with the U.S. "is at odds with the fact that Chinese consumers own more iPhones and buy more General Motors cars than U.S. consumers," wrote Chief China Economist Zhang Zhiwei in the report. "These cars and phones are sold to China not through U.S. exports but through Chinese subsidiaries of multinational enterprises."

Instead of a growing trade deficit with China, Deutsche Bank estimates there was a small but growing surplus. The increase reflected rising demand of Chinese households for foreign goods and services, driven partly by the wealth effect of China’s property boom. The sales surplus with China may exceed US$100 billion by 2020 if the world’s two biggest economies avoid a trade war, Zhang estimates.

The U.S. also ran sales surpluses with nations including Mexico and Canada but had deficits with Japan and Germany last year, Zhang wrote.

A trade war risks the success of U.S. multinational companies, which account for a fifth of employment in America, Zhang wrote. The U.S. unemployment rate is lower than its major trading partners to some extent because of the success of U.S. multinationals, whose businesses overseas boost the American economy, he wrote.

Deutsche Bank used data from the U.S. Bureau of Economic Analysis to estimate overseas sales of U.S. companies through 2015. For more recent sales it turned to multinational companies in the Standard and Poor’s 500 Index that provide sales reports broken down by country and used those to estimate overall sales by American companies in 2016 and 2017.

--With assistance from Xiaoqing Pi