Feb 5, 2024

Top Chinese Hedge Fund Banxia Slashes Stocks for ‘Survival’ in Rout

, Bloomberg News

(Bloomberg) -- A top Chinese macro hedge fund said it slashed stock positions last month as the nation’s market rout deepened, taking losses after acknowledging mistakes betting on a rapid economic recovery.

Shanghai Banxia Investment Management Center “significantly reduced” its equity assets in the middle of January to cut losses, only keeping exposure to safer high-dividend stocks and bigger companies in the CSI 300 Index, according to its January letter to investors.

Banxia recognized its mistakes two weeks into the year, realizing it “must lose an arm for survival,” the firm, led by founder Li Bei, said in the Feb. 4 letter seen by Bloomberg, using a Chinese proverb. That allowed it to “luckily dodge the more fierce declines of the most recent week.”

Li declined to comment.

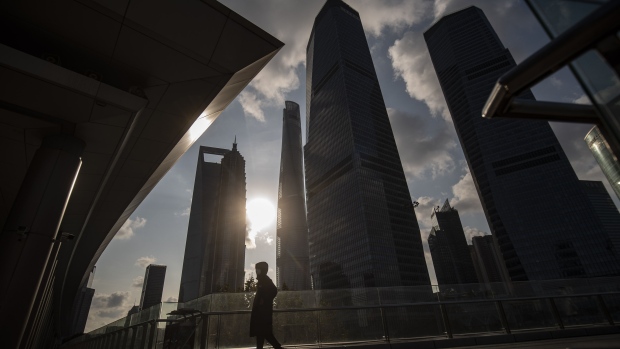

Chinese shares sank to a five-year low on Friday, prompting regulators to tighten trading restrictions on domestic institutional investors as well as some offshore units in a further bid to stem the prolonged rout. Stocks rallied on Tuesday in anticipation of more forceful government efforts to end the slump.

Li, who manages more than 10 billion yuan ($1.4 billion), publicly accepted the blame for wrong-way bets last month, after registering a maximum drawdown of 25% from a peak in the middle of last year, the worst of her career.

Other macro hedge funds have been caught out by China’s stock market slump. Veteran investor Chua Soon Hock decided to shut his Asia Genesis Macro Fund last month after wrong-way bets on Chinese and Japanese stocks inflicted “unprecedented” losses.

While Li turned optimistic from the third quarter after seeing policy shifts, both monetary and fiscal policies “somehow oscillated” in the past month, and the implementation of measures supporting the property market fell “significantly below expectations,” according to the letter.

A “vicious cycle” has developed in the market, after stock indices fell below so-called knock-in levels of “snowball” derivatives that would likely impose losses on investors, the letter said. The widening discount in stock-index futures prompted some quantitative hedge funds’ market-neutral products to unwind trades and sell small-cap stocks.

Quant Exits

The falling small caps led to declines in the quant products, fueling redemptions and then further reductions in their exposure, according to the letter. The exit from such stocks by quants, which Banxia estimated held 1 trillion yuan at the start of the year, was “only less than 20% done.”

However, after a Cailian report on Tuesday that estimated private quants’ stock holdings totaled 660 billion yuan as of Dec. 31, Li wrote in an article on Banxia’s WeChat account suggesting “risk is more controllable.”

The CSI 300 closed 3.5% higher on Tuesday, its best day since late 2022, after Bloomberg reported that regulators are planning to brief President Xi Jinping on the market. In addition, an entity of China’s sovereign wealth fund said it will continue to increase holdings of exchange-traded funds.

The Banxia Macro Fund fell 7.8% in January, after a 14.7% decline last year, according to the letter. Last year it was ranked the best performer among multi-asset funds running at least 10 billion yuan for the previous five years, according to Shenzhen PaiPaiWang Investment Management Co.

The fund has lowered its risk appetite and will keep its net equity exposure below 35% unless opportunities emerge, the letter said. That compared to its target range of as much as 70% last month.

Before the economy strengthens and the property market stabilizes, “we’re prepared for a protracted war,” the letter said.

(Updates with more comments from ninth paragraph)

©2024 Bloomberg L.P.