Sweden’s Economy Keeps Shrinking for a Fourth Straight Quarter

Sweden’s economy posted a fourth consecutive quarter of contraction as interest-rate cuts that could spur activity in the largest Nordic nation are yet to materialize.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sweden’s economy posted a fourth consecutive quarter of contraction as interest-rate cuts that could spur activity in the largest Nordic nation are yet to materialize.

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Greater China’s property market crisis and the challenges it poses for lenders will be on full display on Monday, when embattled developer China Vanke Co. and the region’s biggest banks report earnings.

Hong Kong’s benchmark equity index headed for a technical bull market as a surge in Chinese property shares gave more impetus to this month’s stellar rebound.

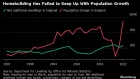

Britain’s homebuilding approval process is failing to cope with a surge in local protectionism that’s driving more costs to the taxpayer

Jul 5, 2018

The average price of a home in the Greater Toronto Area climbed to a 13-month high in June, and the regional real estate board is warning there's no let-up in sight amid an influx of buyers.

There were 8,082 property sales across the GTA in June, an acceleration from the 7,834 sales in May and a 2.4 per cent increase from the previous year.

Active listings of homes available for purchase inched up 5.9 per cent year-over-year to 20,844; while new listings plunged almost 19 per cent.

"It is likely that issues surrounding the supply of listings will persist. This suggests that competition between buyers could increase, exerting increased upward pressure on home prices," said Toronto Real Estate Board Director of Market Analysis Jason Mercer in a release.

RELATED

The twin forces of rising sales and tighter supply drove the average selling price to $807,871 in the month, a modest increase sequentially and from the previous year. It was also the highest average since May 2017, which was the first full month of a new era for buyers and sellers in Ontario after the provincial government implemented a tax on speculators as part of a so-called Fair Housing Plan.

Since then, buyers and sellers have also been adjusting to higher borrowing costs, with the Bank of Canada raising interest rates three times since last summer and the Office of the Superintendent of Financial Institutions introducing tough new stress tests in January for uninsured buyers who put down at least a 20 per cent down payment.

"After some adjustment to the Fair Housing Plan, the new Office of The Superintendent of Financial Institutions (OSFI) stress test requirement and generally higher borrowing costs, home buyers are starting to move back into the market," said Toronto Real Estate Board President Garry Bhaura in a release.