Jun 24, 2022

Tourmaline surge propels Mike Rose's stake past $1B

, Bloomberg News

Tourmaline Oil CEO becomes a billionaire

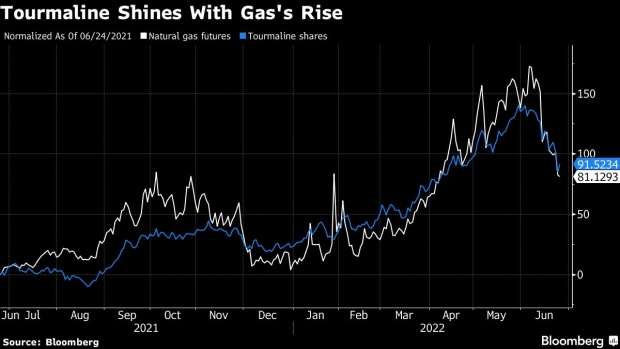

Soaring natural gas prices have propelled Tourmaline Oil Corp. Chief Executive Officer Mike Rose into the ranks of Canada’s billionaires.

Rose, a geologist by training who started four successful oil and gas companies in Calgary, has watched his 4.9 per cent stake in Tourmaline balloon to $1.04 billion from $662 million since the beginning of this year.

Tourmaline, Canada’s second-largest natural gas producer, has jumped 56 per cent over that period thanks to a combination of rising natural gas prices on tight supplies and a series of dividend hikes and special dividend payouts.

The special dividends have netted Rose almost $45 million this year. Tourmaline has also hiked its regular quarterly dividend by 41 per cent over the last 12 months.

Analysts are almost universally bullish on Tourmaline, with 12 buy recommendations and just one hold, from TD Securities analyst Aaron Bilkoski, according to data compiled by Bloomberg. He wrote in a note earlier this month that Tourmaline “has been a fantastic Canadian natural-gas business, with nearly flawless strategic execution over the past several years” but that its valuation had become “stretched.”

While he sees less upside for Tourmaline, Bilkoski still has a buy rating on Topaz Energy Corp., an energy royalty and infrastructure spinoff for which all 14 analysts have buy recommendations. Rose owns a 0.4 per cent stake in Topaz, worth about $12 million.

Tourmaline and Topaz are the third and fourth oil and gas companies that Rose has built into billion-dollar enterprises. He founded Berkley Petroleum Corp. in 1993 and sold it to Anadarko Petroleum in 2001 before starting Duvernay Oil Corp., which he sold to Shell Canada Ltd. for $5.9 billion in 2008.

He’s married to Perpetual Energy CEO Sue Riddell-Rose, whose late father Clay Riddell founded Paramount Resources and was a co-owner of the National Hockey League’s Calgary Flames before his death in 2018.