Apr 5, 2022

Traders Wake Up to Le Pen Risk as French Election Polls Tighten

, Bloomberg News

(Bloomberg) --

Emmanuel Macron’s victory in French elections is no longer clear cut for markets, leading investors to start taking protective action.

Options that protect against a drop in the euro over the next week have risen to the highest level since March 22, ahead of the first round of the French vote on Sunday. The spread between 10-year French government bond yields and that of their German equivalents -- a measure of risk -- has climbed to the highest since April 2020, while a benchmark French stock index slid to underperform peers on Tuesday.

Polls show that President Macron will win the first round to face nationalist leader Marine Le Pen in the second round two weeks later, though the odds on that runoff have narrowed sharply. A poll Monday showed a 51.5% to 48.5% win for Macron, versus a 60% to 40% gap just a month ago.

“There’s been a bit of a wake-up call now that Macron has a very slim lead and traders will start positioning for the risk of a tighter victory or even defeat for Macron,” said Mohit Kumar, a strategist at Jefferies. “The election was not really on people’s radar given that it’s only really recently that Le Pen seems to have gained a lot of ground.”

While it’s not exactly clear what Le Pen would mean for the region, as she has moved away from rhetoric on dumping the euro to court voters hurt by inflation, it would certainly be change for the country’s policies. That’s leading traders to hedge the unknown.

Read More: Le Pen’s Resilience Makes France’s Election a Much Closer Race

Institutional and hedge funds are taking no chances, adding exposure to a fall in the euro, said traders, who requested anonymity as they are not authorized to speak publicly. Demand for exposure to low-probability outcomes, as shown by so-called butterflies, has also picked up since one-month options now cover the second round as well.

Investors are dumping French debt, with benchmark yields up 13 basis points. Bonds from Europe’s periphery such as Italy and Portugal also slumped. Those would be “particularly sensitive” to a Le Pen win, according to Sphia Salim, head of European interest-rate strategy at Bank of America Corp. The end of support from the European Central Bank’s asset purchases is also spurring bigger moves, she said.

In stocks, the CAC 40 Index slid as much as 1.8% Tuesday, nearly double the fall in the region-wide Euro Stoxx 50 Index. Shares with a significant exposure to the French economy such as Societe Generale SA and BNP Paribas SA were among the biggest laggards.

Read More: A Stock Trader’s Guide to French Elections: Winners and Losers

A significant spread widening in French bond yields would be a “clear negative” for both asset managers and insurance companies, said Stephane Monier, chief investment officer at Banque Lombard Odier & Cie SA.

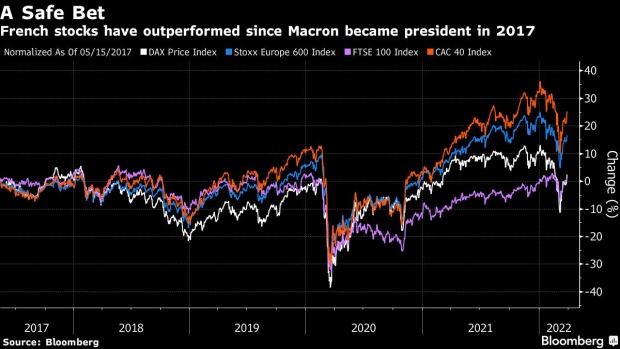

Construction and toll road operator Vinci SA also dropped, down as much as 5.6%. Le Pen has pledged to re-nationalize highways if elected. French stocks overall have outperformed during business-friendly Macron’s presidency.

French politics had sunk lower on the agenda for traders more focused on the broader geopolitical fallout of Russia’s invasion of Ukraine and the impact of soaring commodity prices on central bank policy. Many investors still have an eventual Macron victory as a base-case scenario, which would make any risk premia short-lived.

But with Le Pen drawing on the cost of living crisis, those in Macron’s campaign aren’t being complacent. Macron warned supporters at a rally last weekend that political surprises can happen, citing the U.K.’s vote to leave the European Union.

“A surprise win is still a possibility. What then if Le Pen is elected? The impact could be high as the market is currently not pricing this outcome,” said Marco Bonaviri, head of FX and senior portfolio manager at Reyl & Cie. “We could see the euro depreciate across the board, sovereign periphery spreads widen, euro-zone equities underperform U.S. stocks.”

©2022 Bloomberg L.P.