Oct 22, 2022

Ukraine Crop Deal Fears Boost Food Costs and Slow Shipments

, Bloomberg News

(Bloomberg) -- Ukraine’s farmers are getting increasingly nervous that an escalating war could thwart the renewal of a deal that revived crop exports, dealing a blow to local growers and global food prices.

The pact signed in late July has been a lifeline to the country’s beleaguered farm industry, which historically exports some two-thirds of its grain. It also brought down staple food costs, easing pressure on grocery bills amid a deepening global cost-of-living crisis.

The United Nations -- which brokered the deal with Turkey -- said there are “active” discussions to prolong it beyond mid-November. But forward sales are drying up and ship traffic has declined. The risk that an extension could be scuppered or the agreement’s terms amended has fueled a rebound in grain prices and weighed on plantings.

“It’s the most hot topic that exists in agriculture,” said Svetlana Omelchenko, chief financial officer at Agromino, which farms in central and eastern Ukraine. “If the whole world will help us to succeed in negotiations to prolong the vessel corridor, it means, for the world, more food security.”

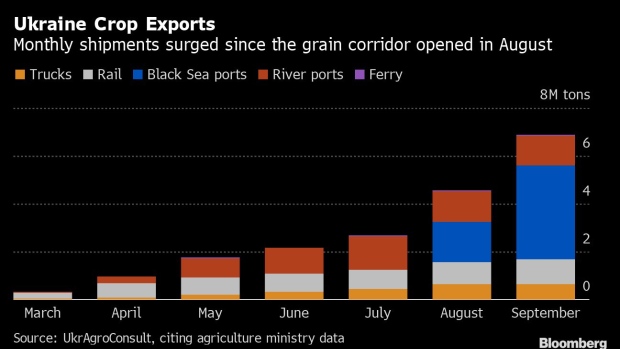

The UN hailed the deal as a step toward relieving global hunger. More than 300 ships have departed Ukraine’s ports since early August, carrying some 8 million tons of grain, oilseeds and vegetable-oil to Europe, Asia and Africa.

That’s helped farmers clear some of the backlog created by the war and doubled Ukraine’s monthly crop exports, with the share sold by sea nearing pre-war levels, according to analyst UkrAgroConsult.

At agribusiness company IMC, grain sales will reach about 65,000 tons this month, versus 10,000 tons in the early months of Russia’s invasion, according to Chief Executive Officer Alex Lissitsa. He expects the deal to be extended, but is seeing signs that traders are growing wary.

Data from Geneva-based AgFlow show no fresh free-on-board offers for Ukraine corn cargoes beyond November, whereas US and South American export prices extend well into next year.

Exports are already being slowed by a backlog of vessels in Istanbul, where Ukraine cargoes must be inspected under the terms of the deal. Vessels were stranded for months in Ukraine’s Black Sea ports after Russia launched its assault, a scenario vessel owners won’t want to repeat.

If ports shut again, farmers will be forced to return to longer and more expensive land and river routes via the European Union, which is also busy handling domestic crops.

Kees Huizinga, who farms about 200 kilometers (124 miles) south of Kyiv, began delivering grain to Odesa as soon as the ports reopened and has since cleared more than 20,000 tons. Transporting that volume via Romania would probably have taken double the time, and he worries trucking backups will swell if the pact doesn’t last.

“The queues for the border will explode again and farmers won’t be able to get rid of all of their products, with liquidity problems as a result,” Huizinga said.

Domestic prices for Ukraine crops are well below their global counterparts, as heftier freight rates and insurance premiums due to war risks lead to farm-gate discounts, said Dmitry Skornyakov, head of farming company HarvEast.

As the deal hangs in the balance, Ukraine has suffered a fraught harvest. Steady rain in September left fields too soggy to collect sunflowers and corn.

Growers are now working to catch up, and the surge in gas prices will boost their costs to dry crops. Unexploded shells on farmland are also complicating fieldwork, according to analyst APK-Inform.

Farmers are also in the midst of plantings for the 2023 season, sowing the wheat and barley for collection next summer. That means they need to make critical calls on purchases of seed, fertilizer and pesticide, with little clarity on how much of their crop they can ultimately export.

Ukraine’s monthly grain shipments could drop to 3 million to 3.5 million tons if the corridor shuts, less than half their potential if it remains open, UkrAgroConsult estimates.

“The grain deal is really that chance to survive for everybody in the agriculture sector,” said IMC’s Lissitsa.

©2022 Bloomberg L.P.