Oct 28, 2022

US Long-Term Inflation Expectations Pick Up, Sentiment Improves

, Bloomberg News

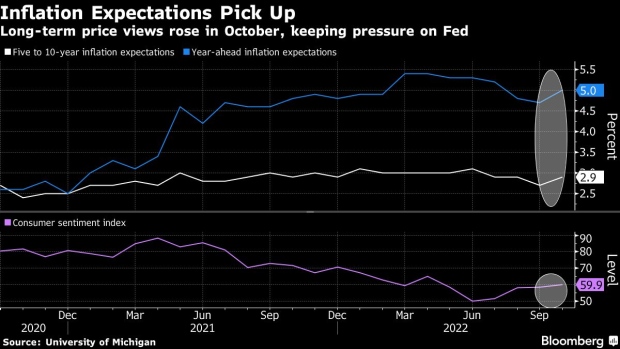

(Bloomberg) -- US long-term inflation expectations picked up in October in a potentially concerning sign for the Federal Reserve as it tries to keep price views steady.

Consumers expect prices will climb at an annual rate of 2.9% over the next five to 10 years, compared to last month’s 2.7%, according to the final October reading from the University of Michigan. They see costs rising 5% over the next year, from 4.7% in September, data Friday showed.

The rise in short-term expectations stemmed in part from higher gas prices in the month, the report said.

The university’s sentiment index increased this month to 59.9, the highest since April. The current conditions gauge also advanced in October to a six-month high, while a measure of expectations dropped to a three-month low.

While buying conditions for durable goods, such as cars and appliances, improved based on easing supply-chain constraints and lower prices, consumers were more pessimistic about the business outlook.

“These divergent patterns reflect substantial uncertainty over inflation, policy responses and developments worldwide, and consumer views are consistent with a recession ahead in the economy,” Joanne Hsu, director of the survey, said in a statement.

The report continued to show a sharp divide along partisan lines in the last reading before the Nov. 8 midterm elections. While sentiment among Republicans remains much weaker than that of Democrats, it improved to the highest since April. Independents also registered a six-month high in sentiment. Meantime, Democrats were less upbeat in October.

President Joe Biden and Democrats have been hoping for good news on the economy as high inflation and recessionary fears have dragged down the party’s chances of holding onto its thin congressional majorities.

That looks increasingly challenging especially as price pressures are still spreading rampantly throughout the economy. Separate data Friday showed a key gauge of inflation watched by the Fed accelerated in September while consumer spending proved resilient. Meanwhile, a measure of labor costs rose at a brisk pace in the third quarter.

--With assistance from Jordan Yadoo.

(Adds graphic)

©2022 Bloomberg L.P.