Dec 18, 2023

Wall Street Forced by Fed to Rethink 2024 Bond Yields

, Bloomberg News

(Bloomberg) -- The epic slide in Treasury yields suddenly unleashed last week by the Federal Reserve forced many Wall Street strategists to jettison days-old forecasts for 2024, but dissent still lingers between bulls and bears.

Bond-market projections for next year that looked pessimistic when they were published in November became untenable as yields slumped following the Fed’s pivot toward cutting interest rates next year. Some already upbeat calls were also completely overtaken by events.

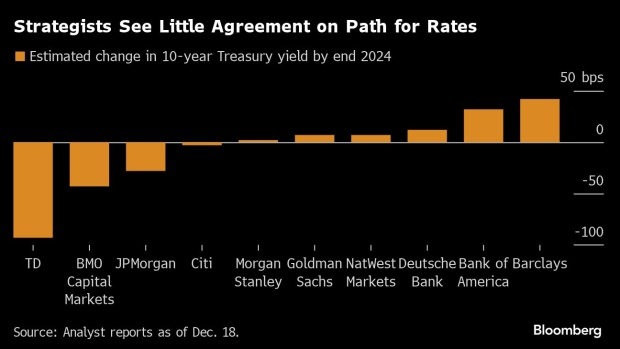

Yet even while many were forced back to the drawing board, major banks are still at odds. TD Securities is among the most bullish on bonds. Bank of America Corp. and Barclays Plc are some of the most skeptical.

The median forecast of strategists at the world’s biggest financial institutions is now for the 10-year US Treasury yield, a benchmark for multiple markets, to fall to 3.98%. That’s hardly far from its level of 3.93% as of Monday’s close, but markedly lower than its yield before the Fed’s pivot: 4.20% — itself down from a 2023 high above 5%.

At the low end, TD Securities thinks the 10-year rate has scope to slump to 3% in a year from now, following 200 basis points of Fed rate cuts beginning in May. Goldman Sachs Group Inc. and Barclays, while capitulating on their views that rate cuts were unlikely before the fourth quarter of next year, forecast yields to end 2024 at 4% and 4.35% respectively.

“Whenever you see that disparate range of estimates, that’s when you know that a trend has come to an end and you’re about to embark on something new,” said Bryce Doty, whose team manages $9 billion in government bond funds at Sit Investment Associates. The Fed’s dovish pivot, Doty added, was “the bell going off telling you we’re at a turning point.”

Others, such as Bank of America, still project the 10-year yield to trade at 4.25% this time next year but concedes that the Fed’s new stance “poses downside risks to our rate forecasts.” Morgan Stanley is at 3.95%, JPMorgan Chase & Co. is penciling in 3.65%, and Citi sees 3.90%.

What Bloomberg Intelligence Says...

“Depending on when cuts begin and at what pace, the market may be getting somewhat ahead of itself. Though there may be consolidation for some time, we still look for the 10-year yield closer to 3% than 4% by the end of next year.”

— Ira F. Jersey and Will Hoffman, BI strategists

Click here to read the full report

This time last year, TD and Citigroup were among those most bullish on Treasuries as multiple investors declared 2023 to be the “year of the bond.”

Such forecasts blew up as the economy and inflation proved more resilient than anticipated and a recession was avoided, leading the Fed to spend much of the year extending the biggest series of rate hikes in decades. Contrary to the expectations of most, 10-year yields exceeded 5% in October for the first time since 2007.

Treasury Analysts’ 2024 Outlooks Aged Poorly: Research Roundup

Bonds are now on course to narrowly avert a third consecutive annual loss after the economy started to fade and the Fed stopped tightening. That sparked the best month for Treasuries since 2008 in November and a pan-market surge in stocks, credit and emerging markets.

“Expectations of 2023 being the year of the bond have not been fully met,” Chris Iggo, chief investment officer of core investments at AXA Investment Managers, said in a Dec. 8 report, before the post-Fed surge in Treasuries. “The performance of government bond markets has been disappointing.”

Goldman Sachs was among a handful to correctly predict what happened, and its team, led by Praveen Korapaty, now says again that the rally will lose steam in 2024.

Others are just kicking the ‘buy bonds’ mantra into a new year. Analysts at Jefferies International Ltd. told clients on Dec. 11 that “we expect 2024 to be the year of fixed income” with bonds outperforming equities as central banks embark on rate cuts. Still, the authors said, “With due respect to analysts across the spectrum, it is likely that 2024 will be another challenging year for macro forecasts.”

Differences between yield forecasts also take into account views on how long the Fed will continue to let its holdings of Treasuries run-off at the pace of $60 billion per month as it moves to offload bonds bought during the pandemic. So-called quantitative tightening, or QT, puts upward pressure on longer-term yields by requiring more debt be sold to service the US’s massive fiscal deficits.

For example, NatWest calls for even more Fed rate cuts in 2024 than TD, but — per a note in early December — expects QT to continue through year-end; TD by contrast expects it to stop when monetary easing begins.

Likewise, JPMorgan and Morgan Stanley have relatively bullish 10-year yield forecasts despite conservative expectations for Fed rate cuts. Both see scope for QT to continue through next year.

And regardless of the pace of the Fed’s balance-sheet unwind, investors are divided over the economic outlook that will ultimately steer policymakers’ path. The prospects of a soft landing, the stickiness of inflation, and the power of the central bank’s policy are all hard to predict, said Sit Investment Associates’ Doty.

“With those three wide-ranging outlooks, you’re going to have an incredible range on interest-rate projections.”

--With assistance from Carter Johnson.

©2023 Bloomberg L.P.