May 19, 2020

Walmart sales soar on consumer stockpiling and shift to online

, Bloomberg News

Walmart Q1 sales surge; Home Depot warns on COVID-19 costs

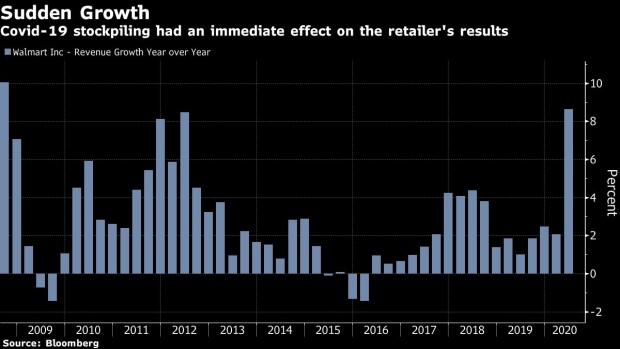

Walmart Inc. posted strong quarterly sales fueled by coronavirus-related stockpiling, showing how it’s one of the few retailers that’s thriving even amid the unprecedented carnage in the U.S. retail sector.

Comparable-store sales, a key retail metric, increased 10 per cent for U.S. Walmart stores in the period, compared with the 8.6 per cent estimate compiled by Consensus Metrix. That’s the fastest pace of growth in almost two decades. Profit in the quarter also beat expectations.

Key Insights

In a closely watched number, Walmart reported its U.S. e-commerce sales rose 74 per cent in the quarter, compared with the average analyst estimate of 51 per cent. To counter rival Amazon.com Inc.’s popular Prime service, the company is rolling out a subscription-based grocery delivery offering and recently introduced a two-hour home delivery service in some markets.

It will also shutter the Jet.com online business, which it acquired four years ago, an unsurprising move as Walmart has been integrating Jet into its broader web unit over the past year.

While Walmart’s sales are up, there’s concern that everyday items like food and toilet paper are less profitable than merchandise like clothing. Fulfillment costs also erode the profitability of online orders. Walmart said gross profit margins narrowed due to a shift to lower-margin categories and web sales along with markdowns and other investments to lower prices. But the e-commerce business lost less money than it did in the year-ago quarter.

The “significant uncertainty” surrounding the length and intensity of the coronavirus’s impact prompted the retailer to withdraw its full-year guidance, given just three months ago. Still, Walmart said its “business fundamentals are strong.” Walmart incurred about US$1.1 billion in additional expenses related to the coronavirus -- from worker bonuses to additional cleaning and purchases of protective gear -- according to Jefferies analyst Christopher Mandeville.

The safety of Walmart’s massive U.S. workforce is also under scrutiny amid reports that some employees have died from Covid-19. Walmart started requiring all store employees wear masks in late April after earlier measures included social-distancing, plexiglass “sneeze guards” and limits on the number of customers allowed in the store at one time. The company’s executives will share more details on their response to the pandemic on a call with analysts this morning.

Market Reaction

Walmart rose as much as 4.9 per cent in premarket trading. The shares had gained 7.4 per cent this year before Tuesday.