Jun 28, 2022

Watch the central banks

Presented by:

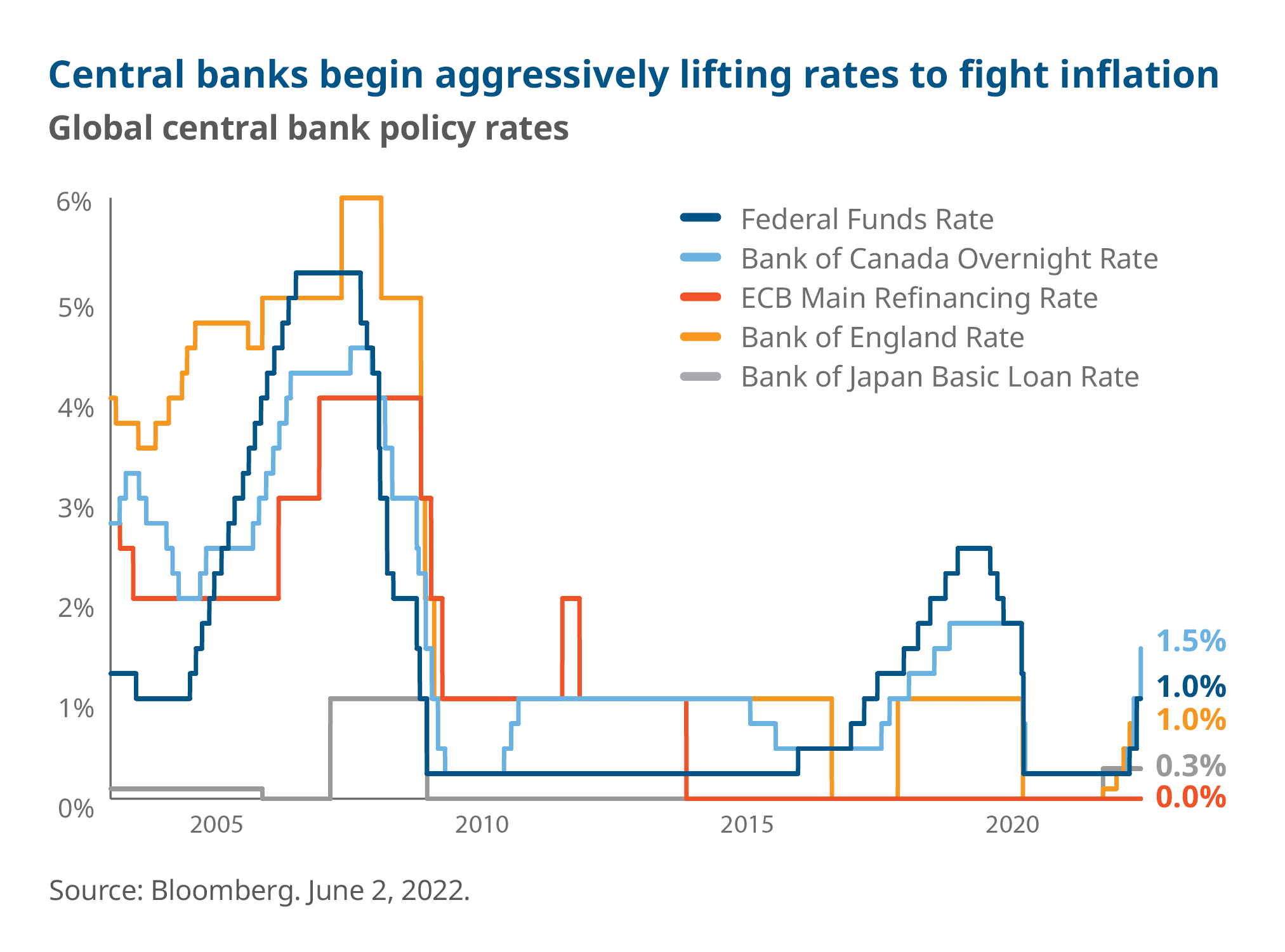

In January, we looked forward to 2022 with a mix of optimism that the COVID-19 pandemic was finally behind us, and trepidation that inflation might continue to creep higher and central banks would tighten policy.

Rather than creeping higher, inflation leapt to levels not seen since the 1980s, forcing central bankers to admit that it was not “transitory” and sending them scrambling to catch up.

The investment world has changed post-pandemic. What worked over the past decade may not be the most prudent course today.

We had already identified a potential for a central bank policy error as a risk. It’s our view that after a late start, many key central banks are now playing catch-up in the fight against inflation. The impact on markets has already been substantial, but we believe investors may be underestimating how high policy rates may rise.

We’re watching economies recalibrating in real time.

History revisited

In the US, Federal Reserve Chair Jerome Powell has been vocal about his admiration of Paul Volcker’s inflation-fighting policies from the late 1970s and early 1980s: a reliance on high policy rates.

We believe this provides a likely road map on how the Fed will continue its policy-tightening cycle in the second half of this year.

By its own admission, the Fed was late to the game raising interest rates, as were other central banks (including the Bank of Canada), having labelled inflation as “transitory” for too long. Now, as the Fed attempts to make up for lost time and tame both demand- and supply-induced inflationary pressures, “expeditiously getting to neutral” has become the new mantra.

Don’t fight the Fed

It is a common understanding that when the Federal Reserve is tightening monetary policy, one should be cautious on their outlook for risk assets. The magnitude of that caution is dependent on the starting point of the cycle and the speed of liftoff. In this case, we had two significant pre-conditions: rock-bottom interest rates and multi-decade high inflation that caused central bankers to move quickly and boldly.

We expect the Fed and other central banks to follow a hawkish path throughout the second half of 2022, prioritizing inflation over exuberant growth, strong asset prices and easy financial conditions.

The Fed will try to prevent a recession, but recent comments have pivoted away from achieving a “soft” landing and towards a “soft-ish” one. This subtle but important shift in language could be a sign that the Fed and other central banks might need to induce a near-recessionary environment to achieve their inflation mandates.

Tighter financial conditions are needed. Not only would this stamp out high levels of inflation, but it would also curtail a frothy labour market, where there are too many job vacancies for the number of unemployed. As a result, wages are rising, potentially undermining the pinnacle of central bank mandates: low and steady long-term inflation expectations. Additionally, the so-called “Fed put”, which normally would have already been activated with the S&P500 down about 20% from its highs, is likely further away than the market realizes.

Hawkishness takes wing…

The Bank of Canada, European Central Bank and Bank of England are all on paths to neutral and possibly beyond. This will likely induce a choppy investment environment in the second half of the year, as the market rotates away from its focus on inflation towards digesting slower growth.

Looking beyond 2022, we believe there is a strong possibility that markets are underestimating central banks’ resolve to stamp out inflation, and the peak for this cycle could prove higher than currently priced in. If true, this would likely have a negative impact on high-risk assets, while further flattening the yield curve.

…But not everywhere

China remains a notable standout, as the inflation response of the People’s Bank of China (PBoC) has been modest. Despite a pledge to step up policy support from the PBoC, credit demand remains weak, with continued COVID-19 restrictions weighing on consumption, production and supply chains.

In fact, many investors have called for more aggressive policy easing to boost both credit demand and supply in the economy. To offset stiff growth headwinds and boost credit expansion, more broad-based monetary easing is needed in addition to the PBoC's current structural, targeted policy tools.

Many central banks are focused squarely on reducing inflation, which can only be achieved by tightening monetary policies to reduce aggregate demand. Although we expect inflation rates to gradually fall this year, the pace of decline is going to be an important variable in how much and how fast central banks tighten policy.

Combined with global supply issues keeping inflation uncomfortably high, a policy-led slowing of economic growth has raised the possibility of a stagflation scenario in the quarters ahead.

This environment presents short-term tactical opportunities, but the best approach is, as always, diversification across asset classes and a long-term time horizon to ride out any short-term turbulence.

Disclaimer

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

The content of this article (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

This article may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of June 3, 2022. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.