Nov 28, 2023

2024 Election to Boost Dollar on Trade-War Tension, JPMorgan Says

, Bloomberg News

(Bloomberg) -- The dollar is set to gain from a divisive US election contest likely between President Joe Biden and former President Donald Trump that will raise prospects for a trade war, according to JPMorgan.

Investors should focus on the impact on currencies from potential trade tariffs, given the commanding lead the protectionist Trump holds among Republican nominees, JPMorgan foreign-exchange strategists including Meera Chandan and Patrick Locke wrote in a Nov. 27 note.

“Renewed tariff risk will be dollar positive,” the strategists wrote. “While the focus on CNY will persist, there is scope for broadening to other FX more directly.”

With the election still close to a year away, JPMorgan notes that the Biden-Trump matchup is likely “if current polling persists.” The strategists also point out that under Biden, tariffs inherited from his predecessor Trump “have largely remained in place.”

Read more: Biden Declares Victory as New Snags, Costs Emerge: Supply Lines

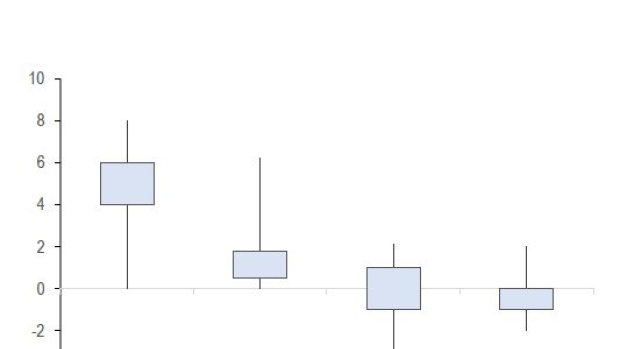

Any future expansion of US economic tariffs on nations and trading blocs beyond China — such as Europe, Mexico, and broader Asia — would have an outsized effect on dollar strength, according to JPMorgan. A universal 10% tariff could boost the greenback’s trade-weighted value by 4% to 6% as a widening trade war weighs on pro-cyclical, growth-sensitive currencies, the strategists said.

Fiscal policy is set to have less of an impact on currency markets as the election progresses, the strategists wrote. While potential fiscal changes were key to foreign exchange risk during the 2016 and 2020 elections, “it’s less clear now that fiscal policy has the same scope to boost the dollar via distinguishing US growth from peers.”

Earlier this month, a Bloomberg gauge of the dollar suffered its worst week since July, erasing its year-to-date gains. The Bloomberg Dollar Spot Index is now on pace for its worst monthly drop since one year ago, when the currency’s sharp slide similarly caught investors wrong-footed.

On Tuesday, the index slipped for the fourth straight session as the dollar lagged almost all of its Group-of-10 peers. Treasuries advanced ahead of an auction of seven-year Treasury notes.

©2023 Bloomberg L.P.