May 10, 2023

A Record Number of Canadians Are Trying to Restructure Their Debts

, Bloomberg News

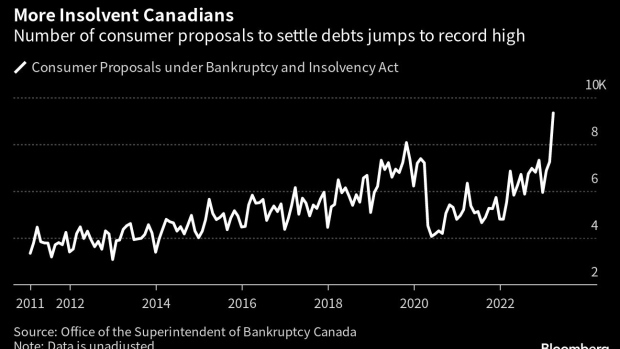

(Bloomberg) -- The number of insolvent Canadians is rising again as higher interest rates pinch households, driving a key measure of financial stress to a record high.

Consumer proposals, or alternative arrangements to settle debts with creditors, rose 36% from a year earlier, according to data released Wednesday by the Office of the Superintendent of Bankruptcy Canada. That brings the monthly total to 9,337, the most since at least 2011.

Total insolvencies, which also include bankruptcies, jumped to 11,768, the highest since the end of 2019. While that’s in part a rebound from near historically low levels, the jump may add to evidence that restrictive borrowing costs are starting to weigh on Canadian households as debt payments eat up a greater proportion of incomes.

“There are some very concerning trends in the data,” Charles St-Arnaud, chief economist with Alberta Central Credit Union, said by email. “It is clear that we are seeing a rise in households struggling and needing to renegotiate the terms of their loans.”

Canadian consumer insolvencies reached the lowest level in two decades after the Covid-19 crisis, as generous government support measures and creditor deferral programs allowed borrowers to keep making monthly payments. Court proceedings were also slowed as governments shuttered offices.

It’s also possible the larger share of proposals stays elevated relative to bankruptcies this time around. Canadian financial institutions are increasingly working with clients to renegotiate loan agreements, including extending amortization periods.

©2023 Bloomberg L.P.