Feb 8, 2022

Stocks resume rally led by cyclicals, small-caps

, Bloomberg News

BNN Bloomberg's closing bell update: Feb. 8, 2022

U.S. stocks rose in a broad-based rally, with gains in cyclicals and small-caps signaling improving investor confidence in the growth outlook amid monetary tightening.

The S&P 500 closed near session highs, recovering ground lost in Monday’s late-day slide, amid gains in financials and materials sectors. Dip-buying in some big tech names like Apple Inc. and Microsoft Corp. helped lift the Nasdaq 100. Meanwhile, the Russell 2000 of small-caps outperformed, jumping more than 1.5 per cent and suggesting confidence about economic reopenings as the pandemic fades.

The 10-year Treasury yield climbed to 1.96 per cent, levels last seen in 2019 with some investors betting it’s heading for 3 per cent this year as the Federal Reserve battles red-hot inflation. The dollar edged higher against a basket of peers.

“The primary market trend appears higher aided by an economy on solid footing and resilient earnings,” Keith Lerner, co-chief investment officer and chief market strategist at Truist Advisory Services, wrote in a note. “We are also encouraged that the market is already pricing in a great deal of rate hikes, that investor sentiment has reset sharply, and that valuations have pulled back.”

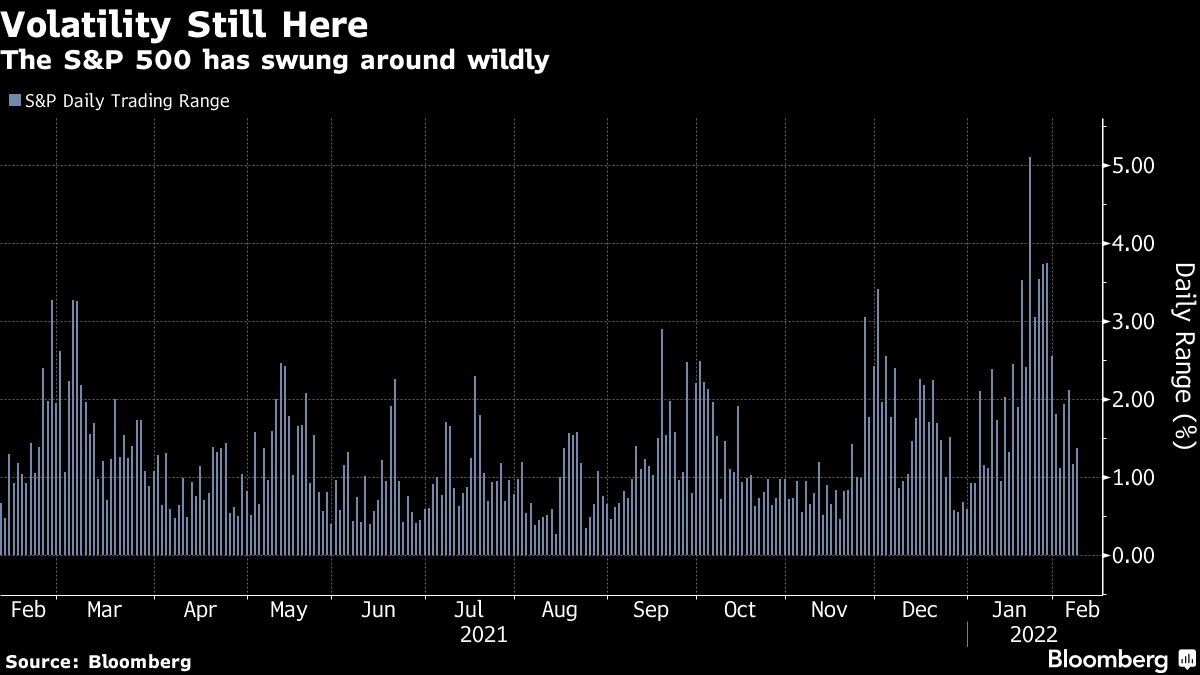

Investors are awaiting data Thursday expected to show stubbornly high U.S. inflation. That could inject further volatility into markets bracing a Fed hiking cycle and eventual balance-sheet reduction. But the rise in yields could also support some equities, like banks and value stocks, according to Goldman Sachs Group Inc., amid generally solid earnings. Of the 299 companies in the S&P 500 that have reported results, 76 per cent have beaten earnings estimates, with profits coming in more than 6 per cent above projected levels.

“We had modest expectations for returns for stocks coming into the year -- I don’t think that’s changed, but I think from here, we could certainly see a constructive recovery,” Brian Nick, chief investment strategist at Nuveen, said by phone. “Every market, not just the equity market, is digesting a relatively rapid pivot from the Fed. I’d say it’s gone relatively well, all things considered.”

Oil fell sharply as traders weighed ongoing tensions in Eastern Europe and the resumption of Iran nuclear talks. Bitcoin declined for the first time in six days, falling below US$44,000.

In earnings and financial market news:

- Microsoft Corp. is considering making a bid for cybersecurity-research and incident response company Mandiant Inc., according to a person familiar with the discussions

- Pfizer Inc. declined after its 2022 revenue forecast missed estimates.

- Harley-Davidson Inc. reported a surprise profit in the fourth quarter as strong demand in its home market and higher motorcycle prices padded earnings and shipping delays eased.

- Coty Inc.’s earnings report was a mixed bag for investors with an upbeat forecast and quarterly revenue that missed expectations.

- Cathie Wood stepped up selling of social media platform Twitter Inc. shares days before its earnings.

- KKR & Co.’s distributable earnings surged 158 per cent in the fourth quarter, beating Wall Street estimates, as the private equity giant took advantage of swelling asset prices to cash out of investments.

- Peloton Interactive Inc. Chief Executive Officer John Foley will step down and become executive chairman, marking a victory for activist investor Blackwells Capital LLC.

Here are some events to watch this week:

- Earnings: AstraZeneca, Commonwealth Bank of Australia, GlaxoSmithKline, Toyota Motor, Twitter, Uber, Walt Disney

- Federal Reserve Bank of Cleveland President Loretta Mester speaks Wednesday

- U.K. Bank of England Governor Andrew Bailey speaks Thursday

- U.S. consumer price index, initial jobless claims Thursday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.8 per cent as of 4 p.m. New York time

- The Nasdaq 100 rose 1.2 per cent

- The Dow Jones Industrial Average rose 1.1 per cent

- The MSCI World index rose 0.5 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.1 per cent

- The euro fell 0.2 per cent to US$1.1418

- The British pound rose 0.1 per cent to US$1.3551

- The Japanese yen fell 0.4 per cent to 115.54 per dollar

Bonds

- The yield on 10-year Treasuries advanced four basis points to 1.96 per cent

- Germany’s 10-year yield advanced four basis points to 0.26 per cent

- Britain’s 10-year yield advanced eight basis points to 1.49 per cent

Commodities

- West Texas Intermediate crude fell 1.8 per cent to US$89.68 a barrel

- Gold futures rose 0.3 per cent to US$1,827.90 an ounce