Jan 5, 2022

Asia Stocks to Fall as Tech Rout Deepens on Fed: Markets Wrap

, Bloomberg News

(Bloomberg) -- Stocks in Asia are set to open weaker after a selloff in U.S. technology shares and Treasuries accelerated once Federal Reserve minutes signaled interest-rate hikes may be more aggressive than many had expected.

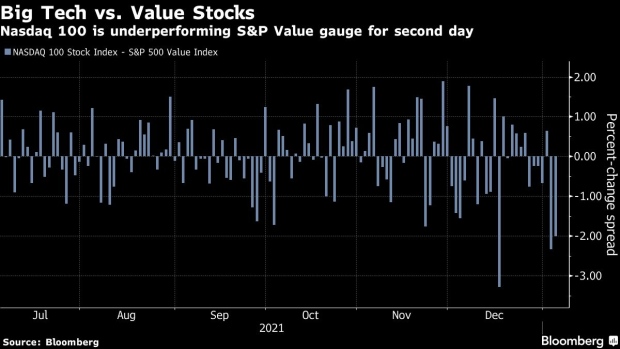

Japan and Australian futures fell. The Nasdaq 100 tumbled the most since March as rising Treasury yields added to concerns over growth and profitability. The S&P 500 dropped as traders increased bets U.S. rates will increase at least three times this year.

The yield on the U.S. 10-year note climbed as high as 1.71%, a level not seen since April. Overnight swaps markets moved to price in an 80% chance of a 25 basis-point hike at the Fed’s meeting in March. The dollar was little changed.

Chinese companies listed in the U.S. extended their decline after Tencent Holdings Ltd. cut its stake in an online gaming company, triggering concerns of similar action at other firms amid Beijing’s regulatory crackdown on the sector. The Nasdaq Golden Dragon China Index -- which tracks Chinese firms listed in the U.S. that conduct a majority of their business in China -- retreated for a fourth straight day.

Investors are focusing on tightening monetary policy as concerns persist about the omicron variant’s threat to global growth and company earnings. Fed officials said a strengthening economy and higher inflation could lead to earlier and faster rate increases than expected, with some also favoring moves to shrink the balance sheet soon after.

“We are prepping people for volatility,” Carol Schleif, BMO Family Office deputy chief investment officer said on Bloomberg Television. “You had another record double-digit year and yet investors’ mood is pretty dour. We definitely think the readjustment of the volatility will increase this year because there is a lot to be dealt with. You do have a leveling off of some things, improvement in some things and people are going to be watching both the Fed and company earnings.”

Meanwhile, restrictions are coming back in some places in the face of omicron. Hong Kong reimposed social curbs and halted flights from eight countries, and U.S. school closings are accelerating as case counts soar.

Elsewhere, Bitcoin tumbled to around $44,000, the lowest since its early-December weekend flash crash. Other cryptocurrencies also declined. Oil edged higher.

What to watch this week:

- Fed’s Bullard discusses the U.S. economy and monetary policy in an event on Thursday

- Fed’s Daly discusses monetary policy on a panel Friday

- ECB’s Schnabel speaks on a panel Saturday

For more market analysis, read our MLIV blog.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.9%

- The Nasdaq 100 fell 3.1%

- Nikkei 225 futures fell 1%

- Australia’s S&P/ASX 200 Index futures fell 0.8%

Currencies

- The Japanese yen was little changed at 116.10 per dollar

- The offshore yuan was at 6.3754 per dollar

- The Bloomberg Dollar Spot Index was little changed

- The euro was at $1.1313

Bonds

- The yield on 10-year Treasuries advanced five basis points to 1.70%

Commodities

- West Texas Intermediate crude rose 0.3% to $77.21 a barrel

- Gold was at $1,809.87, down 0.3%

©2022 Bloomberg L.P.