Dec 5, 2023

Markets today: global bonds power ahead as dovish bets take hold

, Bloomberg News

Reasons why markets could end the year flat

The rally in bonds around the globe gained further traction, with soft economic readings in both the U.S. and Europe fueling speculation that major central banks will cut rates in the year to come.

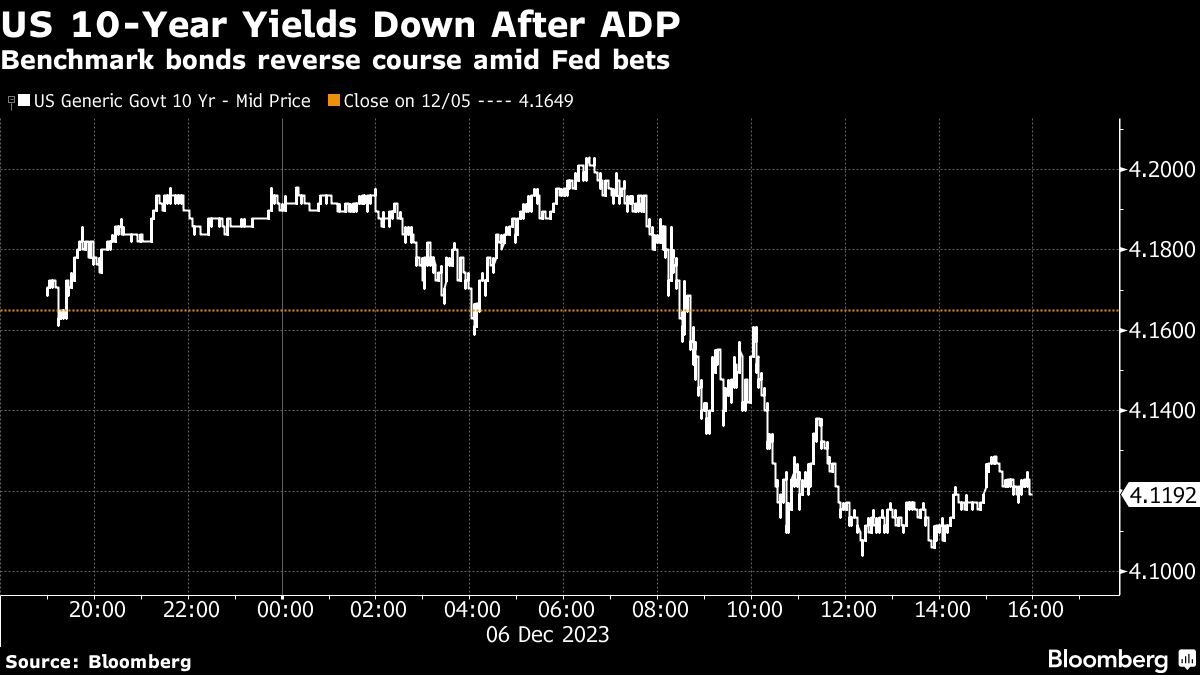

Just two days ahead of the U.S. jobs report, data showed the gradual cooling in the labor market that the Fed would like to see. Private payrolls increased 103,000 last month, trailing estimates and giving further credence to Wall Street’s dovish bid. Germany’s factory orders unexpectedly fell — highlighting how manufacturing in Europe’s largest economy remains stuck in a rut.

A survey conducted by 22V Research shows investors polled believe the period of economic optimism from September to November is over — with the U.S. labor market loosening in January/February. To Stan Shipley at Evercore, Wednesday’s ADP Research Institute payrolls tally and other high-frequency metrics suggest “soft” employment growth.

“The slowdown in hiring continues and is becoming more obvious,” said Peter Boockvar, author of the Boock Report. “What I’m mostly focused on right now is the trajectory of activity — and all I see is slowing in multiple places, including now the labor market.”

U.S. 10-year yields extended their decline to 4.12 per cent. Two-year bond rates edged slightly higher — a healthy sign, according to some traders, after a massive repricing of Fed bets by the front-end of the U.S. curve. The S&P 500 lost steam amid a slide in energy producers and some megacaps like Nvidia Corp. and Microsoft Corp. Oil sank below US$70 a barrel as concern about excess supplies overshadowed a report showing shrinking U.S. inventories.

Fed policymakers meet next week for the last time in 2023. While no change is expected in their target for the federal funds rate, they are scheduled to release quarterly forecasts that could alter market-implied expectations. Those bets have been gravitating toward more easing next year in response to weaker-than-forecast economic data.

Markets fully priced six quarter-point rate cuts by the European Central Bank in 2024 earlier on Wednesday, a move that would take the key rate to 2.5 per cent. Although bets were pared slightly later in the day, Deutsche Bank AG helped stoke the dovish sentiment by revising its outlook to also forecast 150 basis points of cuts.

“Inflation fears are melting,” said Prashant Newnaha, a rates strategist at TD Securities. “Central banks believe they have clearly done enough and may need to cut, otherwise real rates may be too high and restrictive.”

While the ADP report isn’t a reliable predictor of the government’s jobs figures, the weaker-than-expected number may set up expectations for Friday’s jobs report to come in “soft”, according to Chris Larkin at E*Trade from Morgan Stanley.

“What we don’t know is how much the markets have already priced in a slowing labor market, or how they will react if Friday’s data comes in stronger than anticipated,” he noted.

Friday’s government print is forecast to show employers added 185,000 jobs in November, according to a Bloomberg survey of economists. The unemployment rate is seen holding at the highest level in nearly two years.

The combined rally in equities and bonds has been supported by evidence that a soft landing will allow the Fed to cut rates in 2024, according to UBS’s Chief Investment Office, which expects a “softish landing” — but says the pace of the recent rally looks unlikely to be sustained.

“The upside for the S&P 500 is now relatively limited,” said Solita Marcelli at UBS Global Wealth Management. “As growth slows, we believe investors should consider focusing on high-quality stocks from companies with strong returns on invested capital, resilient operating margins, and relatively low debt on their balance sheets.”

Meantime, the Bank of England stepped up warnings about hedge funds shorting U.S. Treasury futures, saying its measure of the net position is now larger than before the “dash for cash” crisis in March 2020.

The net short position has grown to $800 billion from about $650 billion in July, the central bank said, citing calculations based on Commodity Futures Trading Commission data. That suggests a jump in the so-called basis trade, which is where investors seek to exploit price differences between futures and bonds.

And the heads of Wall Street’s biggest banks took their most direct swing yet at Washington’s plans to force them to set aside more cash as a buffer against losses.

Corporate Highlights:

- Citigroup Inc.’s Chief Financial Officer Mark Mason said the Wall Street giant remains on track to deliver full-year revenue that’s in line with the firm’s earlier guidance despite a slump in trading revenue.

- Apple Inc., seeking to reverse a decline in Mac and iPad sales, is preparing several new models and upgrades for early next year, according to people familiar with the situation.

- Advanced Micro Devices Inc., taking aim at a burgeoning market dominated by Nvidia Corp., unveiled new so-called accelerator chips that it said will be able to run artificial intelligence software faster than rival products.

- Exxon Mobil Corp. plans to raise share buybacks 14 per cent as the oil giant accelerates crude production in the U.S. Permian Basin, boosted by its $60 billion acquisition of Pioneer Natural Resources Co.

- Toll Brothers Inc.’s executives pointed to “solid” demand in recent weeks as mortgage rates pulled back from two-decade highs.

- Tesla Inc. suffered a blow in its labor dispute in Sweden after an appeals court withdrew an injunction allowing the company to pick up license plates for new cars directly from the manufacturer.

- McDonald’s Corp. is looking to hit 50,000 locations around the world by 2027 in what the company calls the fastest expansion spurt in its history.

- Carson Block said he’s short Blackstone Mortgage Trust, saying the publicly traded real estate investment trust is exposed to a perfect storm of economic conditions hitting commercial real estate and may face a liquidity crisis.

- Merck KGaA’s experimental multiple-sclerosis drug failed in late-stage trials, a blow to the German company’s plans to drive growth with another blockbuster medicine.

Key events this week:

- China trade, forex reserves, Thursday

- Eurozone GDP, Thursday

- Germany industrial production, Thursday

- U.S. wholesale inventories, initial jobless claims, Thursday

- Germany CPI, Friday

- Japan household spending, GDP, Friday

- Reserve Bank of Australia’s head of financial stability Andrea Brischetto speaks at Sydney Banking and Financial Stability conference, Friday

- U.S. jobs report, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.4 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.6 per cent

- The Dow Jones Industrial Average fell 0.2 per cent

- The MSCI World index fell 0.1 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.3 per cent to $1.0763

- The British pound fell 0.3 per cent to $1.2556

- The Japanese yen fell 0.1 per cent to 147.37 per dollar

Cryptocurrencies

- Bitcoin fell 0.2 per cent to $43,792.41

- Ether fell 0.8 per cent to $2,255.69

Bonds

- The yield on 10-year Treasuries declined four basis points to 4.12 per cent

- Germany’s 10-year yield declined five basis points to 2.20 per cent

- Britain’s 10-year yield declined eight basis points to 3.94 per cent

Commodities

- West Texas Intermediate crude fell 4.2 per cent to $69.31 a barrel

- Spot gold rose 0.4 per cent to $2,026.75 an ounce