May 24, 2022

Banks in Canada face weak profit gains before rate hikes kick in

, Bloomberg News

I think we're seeing some good things for the banks: Robert Colangelo

Canada’s banks are expected to post their slowest earnings growth in almost two years as the darkening economic outlook prompts them to stockpile capital before increases in interest rates start improving their lending margins.

Net income at the country’s six largest lenders is projected to have risen 3.4 per cent in the quarter through April. That would be the smallest year-over-year gain since average profit fell 18 per cent in the third quarter of 2020. Fiscal second-quarter results kick off Wednesday with reports from Bank of Nova Scotia and Bank of Montreal.

Rate hikes this year have started to slow the nation’s housing market, which accounted for most of the banks’ loan growth during the pandemic, while doing little so far to boost what lenders are able to charge their borrowers. With the prospect of a rapid tightening cycle rattling markets and reducing economic-growth forecasts, the banks are expected to set aside more money to protect against potential loan losses, restraining their earnings growth.

“Based on how the market has shifted in terms of greed versus fear over the last three months, expectations are that the banks are going to be a bit more heavily weighted toward a negative economic scenario,” John Aiken, an analyst at Barclays Plc in Toronto, said in an interview.

| Reporting Date | Banks |

|---|---|

| May 25 | Bank of Nova Scotia, Bank of Montreal |

| May 26 | Royal Bank of Canada, Toronto-Dominion Bank, Canadian Imperial Bank of Commerce |

| May 27 | National Bank of Canada |

Canada’s Big Six are expected to have set aside $1.17 billion (US$912 million) to protect against bad loans last quarter. That would be more than three times the $373 million they set aside in the fiscal first quarter. The banks had released provisions in the two quarters before that.

However, analysts have consistently overestimated banks’ level of caution on the credit front in recent quarters. The banks’ first-quarter provisions came in at about 40 per cent of what analysts had forecast. A similar overestimation of provisions this quarter would boost banks’ earnings beyond analysts’ current projections.

It’s possible that analysts’ expectations for the quarter are “being tempered by the outlook for the rest of the year, not necessarily for this quarter,” Aiken said.

While provisions may weigh on profits, they’re unlikely to determine investors’ reactions to the banks’ results, Aiken said. For share performance, revenue will be more important, he said.

Commercial lending should be the strongest category as businesses play catch up with demand, Aiken said. Mortgage lending also should continue to grow, though probably not at the heated pace of recent quarters, he said, while personal loans and credit cards are more of a question mark.

Management commentary is likely to be scrutinized more closely than usual, said James Shanahan, an analyst at Edward Jones in St. Louis.

“I suspect that there will be less of a reaction to reported results than to management comments about the outlook because that was more of a focus when the U.S. banks reported a few weeks ago,” Shanahan said in an interview. “I expect a lot of questions about loan growth, their current outlook and what happens if you economic activity slows.”

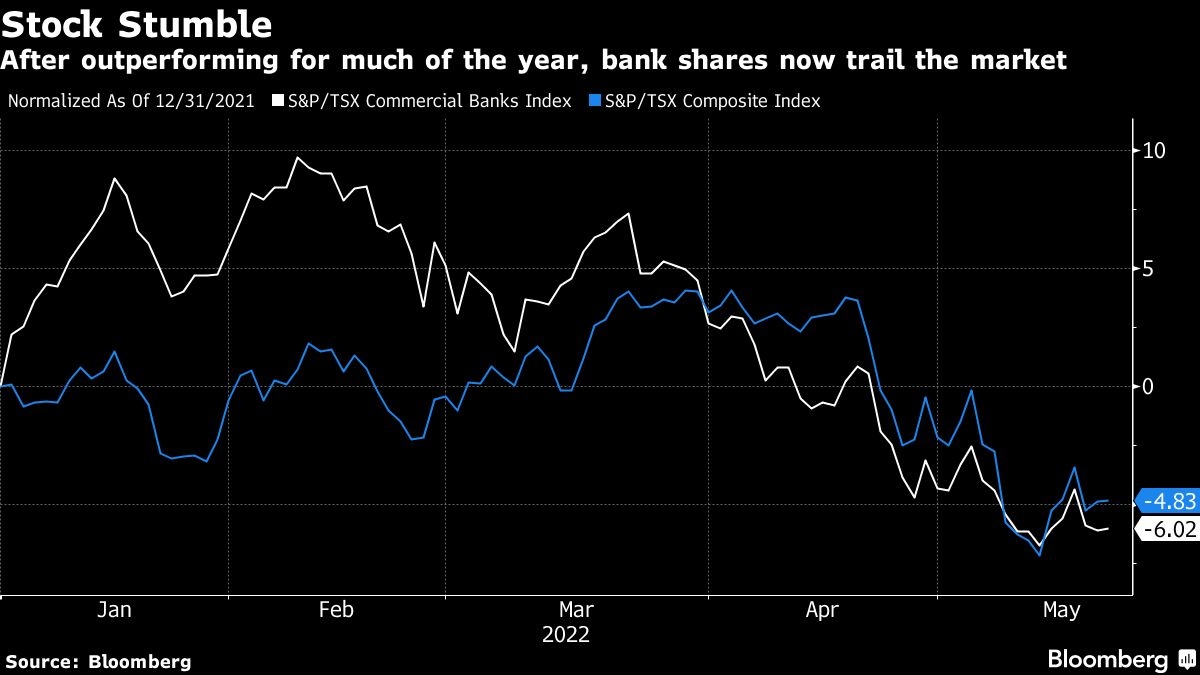

The S&P/TSX Commercial Banks Index has slid 6 per cent this year, more than the 4.8 per cent drop for the broader S&P/TSX Composite Index. The deteriorating economic picture already has prompted analysts, including those at Barclays and Desjardins, to trim their price targets for Canadian banks.

Unfortunately for the banks, the profitability of their lending operations isn’t expected to have benefited much yet from the Bank of Canada’s two interest-rate increases this year. Net interest margins for Canada’s largest banks are projected to be 1.75 per cent, up only one basis point from the first quarter, according to analysts’ estimates compiled by Bloomberg.

Outside of banks’ core lending businesses, wealth-management earnings may be challenged as falling equity markets curtail customers’ appetite for investing and shrink assets under management, Aiken said.

Expectations for banks’ capital-markets divisions are also mixed as investors wait to see whether trading-volume gains from the recent turbulence in markets are enough to make up for a dropoff in financing and merger activity.

Looking ahead to the rest of the year, additional interest-rate increases are expected to boost banks’ net interest margins. Markets are pricing in a 50-basis-point rate hike by the Bank of Canada next month, bringing its policy rate to 1.5 per cent. That figure is expected to reach 2.75 per cent by the end of this year.

But those increases also heighten the risk of an economic slowdown, which could hurt banks’ lending businesses, said Paul Holden, an analyst at Canadian Imperial Bank of Commerce.

“We believe we are heading into a period of economic weakness, and that is when revenue diversification beyond core personal and commercial banking tends to be most beneficial,” Holden said in a note to clients. “While net interest margins are expected to expand in the next few quarters with aggressive central-bank tightening, there is a risk of an overshoot, recession and loosening monetary policy in response.”