Oct 10, 2023

Birkenstock’s $1.6 Billion IPO to Test Newly Uncertain Market

, Bloomberg News

(Bloomberg) -- Birkenstock Holding Plc’s initial public offering is expected to price Tuesday after the trading day ends, the last of four big listings seen as pacesetters for US equity markets.

The German company, whose name is synonymous with broad-strapped leather sandals befitting a medieval monk, expects to price the offering at the top of its $44-to-$49 per-share range when it meets with its advisers on Tuesday, according to people familiar with the matter, who asked not to be identified discussing confidential information.

Birkenstock and private equity owner L Catterton are seeking to sell about 32 million shares to raise as much as $1.58 billion, which, at $49 apiece, would value the company at roughly $9.2 billion.

The offering is set to price less than a month after UK chip designer Arm Holdings Plc, backed by SoftBank Group Corp., raised $5.23 billion in the year’s biggest listing. Grocery delivery startup Instacart’s $660 million IPO and marketing and data automation provider Klaviyo Inc.’s $576 million offering followed, breaking a nearly two-year US listing drought.

September was a simpler time, though. Since then, those stocks have delivered mixed results. One US government shutdown was narrowly averted while another is looming, and now the Hamas attack on Israel is rattling markets.

Read More: Birkenstock Gears Up for Roadshow in Next Test of IPO Market

Of last month’s three IPO trailblazers, Instacart was the only consumer-focused company and has fared the worst, dropping 12% from its IPO price.

A representative for Birkenstock declined to comment.

Cautionary Tales

Two shoemakers that went public in 2021 serve as cautionary tales for Birkenstock. Shares of the Zurich-based company that makes On Running shoes, which didn’t become profitable until last year, has gained 8.8% since its IPO, while Allbirds Inc.’s shares that sold for $15 in its IPO now are trading for about 97 cents and its losses are forecast to keep growing.

Birkenstock has one big edge over those peers, Bloomberg Intelligence analyst Abigail Gilmartin said in an interview.

“They have really strong profitability,” she said. “They’re not just not a top-line story.”

Gilmartin said she expects Birkenstock to fare “pretty well” when it begins trading, laying the groundwork for other companies—especially profitable ones—to follow.

Birkenstock could be the last big US listing this year, partly because a government shutdown would leave the US Securities and Exchange Commission without enough staff to keep up with filings. Companies across sectors will base their decision on whether to pursue IPOs early next year based at least in part on Birkenstock’s debut.

The dozens of potential listing candidates include an array of businesses as diverse as activewear brand Vuori Inc., weight-loss drugmaker Carmot Therapeutics and GameChange Solar, whose backers include a Koch Industries affiliate, Bloomberg News has reported.

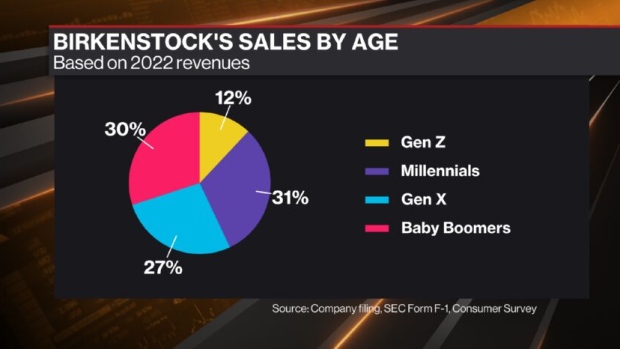

Founded nearly 250 years ago, Birkenstock’s sandals have been sold in the US since 1966 and have demonstrated a strong cross-generational appeal, with baby boomers and millennials accounting for almost equal portions of its 2022 sales. The company has become a high-fashion brand, launching collaborations with luxury names such as Dior, Manolo Blahnik and Valentino, and spawning variants from labels including Celine and Givenchy.

Birkenstock’s sales have been boosted by the blockbuster Barbie movie, which stars Margot Robbie in the title role donning a pair of the sandals in pink.

Like the IPOs before it this fall, the company is looking to stabilize its listing with anchor investors. Billionaire LVMH Chairman Bernard Arnault’s family holding company, which has already invested in Birkenstock, may buy as much as $325 million of shares. The Norwegian sovereign fund and T. Rowe Price Group Inc. veteran Henry Ellenbogen’s Durable Capital Partners have expressed interest in buying as much as $300 million of stock in aggregate, according to the filing.

As much as 8% of the shares in the listing have been set aside for employees at the IPO price, according to the filing.

The company is selling 10.8 million of the shares in the IPO, while L Catterton is offering 21.5 million and will continue to own about 83% of the stock and control the company, according to the filings.

L Catterton stands to double its investment if the IPO goes as intended. The firm acquired the company for €4 billion ($4.2 billion), Bloomberg News reported, in a transaction completed in April 2021 that included the Arnault company. The deal value was not publicly disclosed.

The offering is being led by Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley. Birkenstock shares are expected to begin trading Wednesday on the New York Stock Exchange under the symbol BIRK.

--With assistance from Crystal Tse.

©2023 Bloomberg L.P.