Apr 8, 2019

Bond Markets at Risk of Misstep on Inflation, Fidelity Says

, Bloomberg News

(Bloomberg) -- As fears of slowing growth spark a frenzy of bond buying around the globe, Fidelity International’s George Efstathopoulos has another risk on his mind: surprise inflation.

The money manager, who helps oversee a multi-asset fund that beat 98 percent of its peers over the past year, reckons markets are too downbeat on global growth. Investors are also too sanguine on inflation which could emerge in the second half of the year, spurring major central banks to re-evaluate their dovish outlooks.

“The market’s gotten a little bit too excited about dovish tones and starting to price in easing,” Efstathopoulos said in an interview in Singapore. With U.S. economic growth still at or above trend, which could in theory support a Fed normalization policy, “I still see the next step is rates up rather than down,” he added.

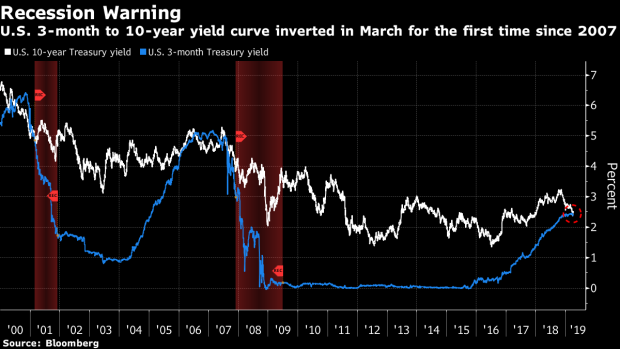

Government bonds from Europe to Japan have rallied as worries of cooling global growth spooked investors to seek shelter in sovereign debt. Bond yields in Australia and New Zealand plumbed fresh lows in March and a closely-watched part of the U.S. curve inverted -- seen as a harbinger of recession -- as investors bet the Fed would need to cut rates.

Fidelity’s view chimes with the likes of Aviva Investors and hedge fund CQS who reckon caution in markets and recession fears look overdone. As strategists from Goldman Sachs Group Inc. to JPMorgan Chase & Co. lower their outlooks for Treasury yields, signaling the rally in bonds could continue, Efstathopoulos is holding back from adding U.S. duration to his portfolio.

He sees 10-year Treasury yields trading as high as 3 percent this year, especially if key economic indicators such as purchasing manager indexes and industrial data from Europe to Asia continue to improve. Benchmark 10-year Treasury yields were trading at 2.50 percent in Asia Monday after slipping 2 basis points on Friday, after a further call for lower rates from President Donald Trump.

If inflation comes through “that will not only reprice curves in those markets -- but it will also reprice meaningfully the U.S. market,” he said. “I’d rather not be taking duration risk at the long end of the curve today.”

Here are edited comments of Efstathopoulos’s other investment views:

Trim Dollar Longs

I see the greenback tracking sideways for 2019. It may strengthen slightly against the likes of the euro, and weaken against a basket of emerging-market currencies. Long positions in the dollar now make up about 80 percent of our currency exposure, down from a peak of 90 percent last year.

Long Emerging Markets

Developing-nation central banks including those of Indonesia and India may cut borrowing costs after raising interest rates to protect their currencies last year. We are long Indonesia’s rupiah and government bonds, and also like emerging-market hard currency debt. EM currencies look cheap whichever valuation measure we look at.

China Stocks Bull

We’ve been selling equities in places like Taiwan, Korea and Australia and rotating the proceeds of that into China equities. Liquidity has been tightening a bit but the domestic growth story is still very much intact in China.

Australia Bond Bet

We were buying a lot of Australian bonds in the fourth quarter of last year. We’ve stopped adding but we haven’t taken profits on the trade yet -- there’s potential for the market to price in a bit more easing still.

Buying Yen

Fidelity is long yen against the dollar even after taking some profit on the trade in January. The position, which was built up in the fourth quarter, has added 25 basis points to the overall portfolio’s performance thanks to a strong December.

(Updates 10-year yield level in sixth paragraph.)

To contact the reporter on this story: Ruth Carson in Singapore at rliew6@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Cormac Mullen

©2019 Bloomberg L.P.