Oct 11, 2022

China Markets Keep Showing Any Reopening Bets Are Fool’s Errand

, Bloomberg News

(Bloomberg) -- Markets got their latest signal that China’s Covid Zero policy is here to stay in a commentary carried Tuesday by the Communist Party’s flagship newspaper, which endorsed the efforts for the second day in a row.

Asset classes globally were already swooning due to inflation angst, and there was nothing particularly new in the People’s Daily piece. But it still underscored the difficulty of any bullish bets on nearer-term prospects for a dialing back of strict Covid measures.

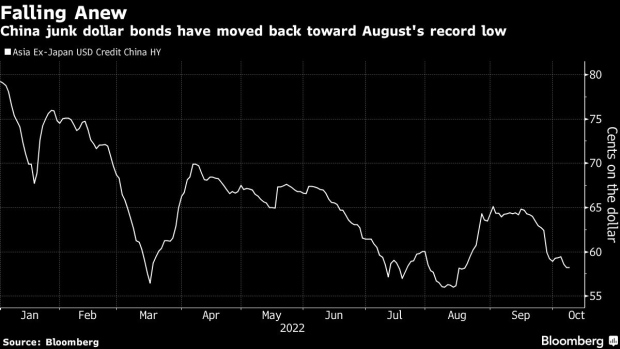

Chinese junk dollar bonds -- most of which are from the property sector where home sales have fallen amid Covid curbs -- dropped 1 to 2 cents Tuesday, following three weeks of declines that was the longest streak since July. Average prices have now fallen to about 57 cents, near a record low in August.

A Bloomberg Intelligence gauge of Macau casino shares slid 4.7% after a 4.8% drop Monday, for the worst two-day retreat since March. Tourism revenue slumped across China during the recent week-long National Day holiday.

The declines mark a shift from late September, when investors were cheered by Macau announcing that tour groups from mainland China would resume as soon as November. Some casino notes had their biggest rally in more than two years then.

“The damage from Covid Zero is often thought of as short term, as if reopening the economy will be like turning a light switch back on. This is an error,” according to Bloomberg Economics’ Eric Zhu and Chang Shu.

Domestic Covid curbs have added to a slew of recent negative news, including US restrictions on technology exports to China and an intensified Russia-Ukraine war, said ANZ Bank China Co. senior Asia credit strategist Ting Meng.

For developers, CIFI Holdings Group Co. and China SCE Group Holdings Ltd. led the day’s weakness, with some bonds falling more than 5 cents.

(Updates prices)

©2022 Bloomberg L.P.