Mar 8, 2022

Costco’s Domestic Focus Offer Haven From War Shocks, Analysts Say

, Bloomberg News

(Bloomberg) -- Costco Wholesale Corp. extended its rally as analysts touted the retailer’s safer domestic focus while Russia’s invasion of Ukraine sends shock waves through markets around the world.

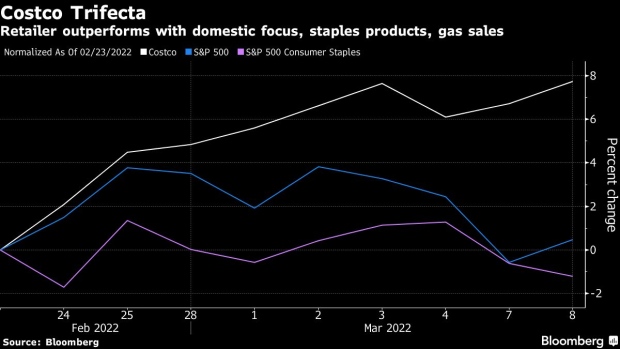

The stock, up as much as 2.1% on Tuesday, has gained every day except one after the war broke out, and has advanced about 8% overall since then. That’s better than the drop of about 1.2% in the S&P 500 Consumer Staples Index, and an almost flat return for the broader S&P 500.

Costco is one of the best-positioned retailers in the current environment, according to Cowen Inc. analyst Oliver Chen, who called it one of his best defensive ideas. He cited its high percentage of domestic operations, less exposure to commodity prices and “exceptional” pricing power. For similar reasons, Chen also likes Ulta Beauty Inc. and Planet Fitness Inc.

Oppenheimer’s Rupesh Parikh reiterated Costco as a top pick, also for defensive reasons, citing the extra shoppers who are likely to be drawn by Costco’s discounted gasoline. Parikh is seeing wider price gaps than in recent months between the retailer’s gas price per gallon and other gas stations.

The discount may hurt margins in the short term, but Costco will benefit from strong growth in gallons sold and the increase in store traffic that it generates, Parikh said.

Chen rates Costco shares outperform, with a $650 price target, which matches the Street-high held by at least two other firms tracked by Bloomberg. Parikh also has an outperform rating on the stock. His price projection is $580 a share. The stock was hovering near $530 at midday in New York.

Costco has 24 buy-equivalent ratings, 13 holds, and just 2 sells. The average 12-month price target is $571, implying 7% upside to its current trading price.

©2022 Bloomberg L.P.