Oct 31, 2022

ESG Fund Labels Disappear in Japan as Clampdown Spooks Industry

, Bloomberg News

(Bloomberg) -- ESG is becoming a bit of a dirty acronym in Japan.

In the last five months, no new fund has put “ESG” in its name, a sharp drop from roughly one a month for the past few years. Products still identify themselves as “green” or “impact” or “sustainable,” but since the Financial Services Agency signaled new regulations on ESG-labeled funds, asset managers have stopped using the shorthand for environmental, social and governance.

“The FSA has been warning fund managers about misleading individual investors with ESG labels, and asking them to come up with specific reasons for the stocks they invest in,” Shoko Shinoda, a fund analyst at Rakuten Securities Inc., said in an interview. “That’s why asset managers are more cautious.”

Global regulators are introducing more rules to crack down on greenwashing by self-labeled ESG funds. Singapore and Hong Kong have both mandated extra disclosure requirements. In Europe, where sustainable investing is more formally regulated, asset managers are just getting to grips with new true-to-label rules that will result in hundreds of funds downgraded from the strictest ESG category to a less stringent one.

Japan’s FSA kickstarted discussions on ESG fund rules last year, after a popular fund managed by Morgan Stanley and sold by Mizuho Financial Group Inc. came under scrutiny for offering investors insufficient information about its environmental and social impact. The financial watchdog is set to release new guidelines by March.

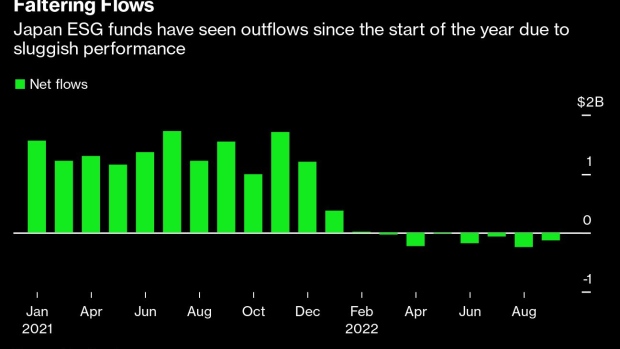

Japan, which has latched on to the ESG fund craze more than any other country in Asia, has seen outflows this year of about $426 million from these funds. Assets under management have slipped to about $21.9 billion, from $34.3 billion at the end of last year, excluding exchange-traded funds, based on Morningstar Inc. data.

The asset decline is due to a weaker yen and sluggish performance as most of the funds are focused on global equities and have been hit by the stock sell-off this year, according to Hiroaki Sato, associate director of manager research at Ibbotson Associates Japan. The three largest funds, which make up one-third of total assets under management, are down 8.3% this year on average, compared with the Nikkei Index’s 4.2% drop.

“With ESG fund flows losing its momentum, there aren’t incentives for companies to launch new funds,” Sato said. Just 18 ESG funds launched this year, compared with 56 over the same period last year, according to Morningstar. The last fund using the ESG label -- ESG Gold Capital AM -- launched on May 20.

While the FSA’s caution has cooled the ESG boom, stricter disclosure guidelines could help attract more flows, Shinoda said. “Retail investors are interested in ESG and impact investments,” she said. “What they’re looking for is more transparency, why fund managers choose the stocks they do. That will help a lot.”

Resona Asset Management Co. will push out a new ESG-named fund this month, ending the five-month drought.

--With assistance from Takashi Umekawa.

©2022 Bloomberg L.P.