Mar 19, 2021

Fortress Said to Offer Earlier Payout on Mt. Gox Creditor Claims

, Bloomberg News

(Bloomberg) -- Fortress Investment Group LLC is offering the creditors of defunct crypto exchange Mt. Gox an earlier but lower payout than they would get under a trustee-backed proposal set for a vote in October.

This is the highest value that the private-equity and hedge-fund firm has ever offered creditors, according to a letter seen by Bloomberg News. Officials of New York-based Fortress didn’t immediately respond to a request for comment.

The Civil Rehabilitation plan from Mt. Gox’s Japan-based trustee, the one set for an October vote, would refund creditors of the defunct Japanese exchange about 90% of their claim value, while Fortress is offering about 80%. However, Fortress said the Civil Rehabilitation plan payments would likely occur in mid-2022, and its own proposal would offer liquidity now.

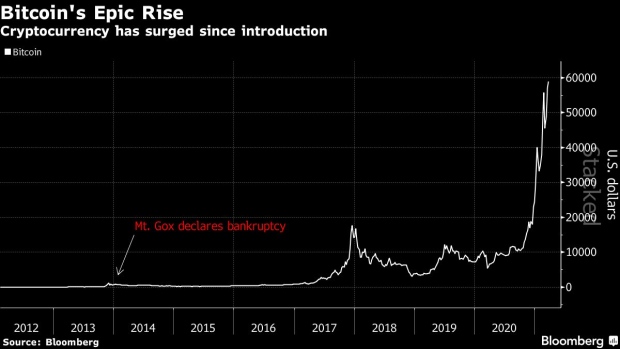

Fortress has been buying up Mt. Gox claims for years, offering as much as $1,300 per Bitcoin, and as little as $600 per Bitcoin. Since then, Bitcoin’s price has rallied to new highs, recently hitting a record above $61,000.

Mt. Gox was once the world’s biggest Bitcoin exchange, until it closed in early 2014 after losing the coins of thousands of customers. Some of the holdings have subsequently been found. The trustee is working to reimburse creditors, though the process has been delayed by lawsuits.

Creditors would get the full amount owed them in cash, Bitcoin or Bitcoin Cash, whichever they made their deposits with, under the Fortress proposal. Other coins will be turned into fiat currency and reimbursed as well. There’s still uncertainty about whether the creditors will approve the plan.

Fortress and many other companies figure that some investors can’t or don’t wish to wait for the uncertainty around when they will be reimbursed to end, and may choose to cash out now -- hence the thousands of letters it’s now sending out to Mt. Gox creditors.

“Rather than waiting another 1 to 1.5 years, we are offering a liquidity option for creditors who want to receive cash or BTC now,” Michael Hourigan, managing director at Fortress, said in the letter. Fortress has been owned by SoftBank Group Corp. since 2017.

To determine the payout value of a claim, Fortress is using a calculator constructed by Mt. Gox creditor Kim Nilsson.

©2021 Bloomberg L.P.