Nov 17, 2021

Gen Z has US$360B to spend, trick is getting them to buy

, Bloomberg News

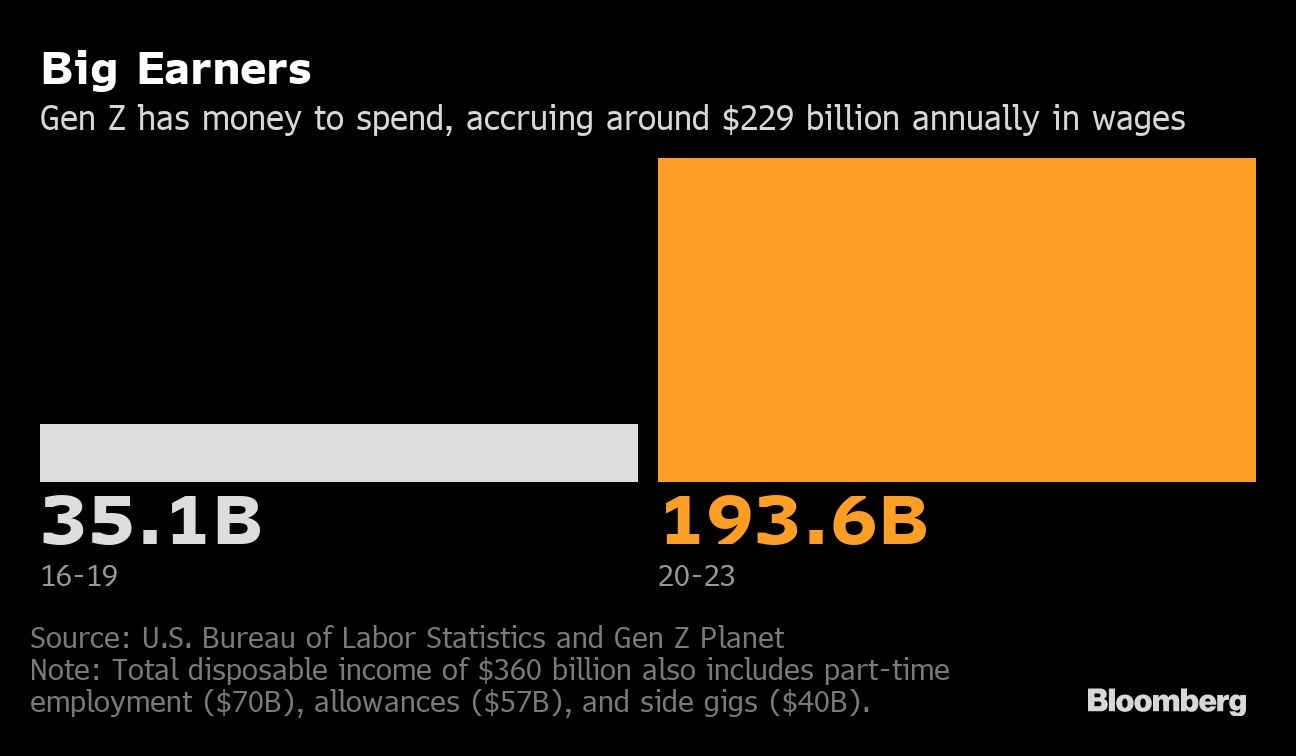

If companies seem to be obsessed with Gen Z, it may be for good reason. The cohort has US$360 billion in disposable income, more than double an estimate from three years ago.

An increasing number of Americans in their early 20s and teens are working full-time jobs or making money with side hustles, according to a report from research and advisory firm Gen Z Planet.

Gen Zers also continue to save a lot of those earnings, backing up their reputation as thrifty consumers who’ve been shaped by economic uncertainty and learning early on how to find deals online. On average, they put away about a third of their income, the report said.

“They’re kids of the 2008 recession, and now they’re the graduates of the COVID pandemic,” said Hana Ben-Shabat, founder of Gen Z Planet. “Those two things really influenced a lot of how they view money.”

Retailers and brands are increasingly trying to figure out how to court this group because the key to longevity is winning over multiple generations of consumers. That’s been a struggle for department stores and clothing chains.

The phrase “Gen Z” was mentioned 64 times in S&P 500 earnings calls so far this year, more than twice as often as all of 2020. Tapestry Inc., the parent company of Coach, boasted to analysts last week that 40 per cent of its new customers are Gen Z or millennials. American Express Co. and Estee Lauder Inc. also identified Gen Z as a prime target.

On an annual basis, there are around 7.3 million full-time Gen Z workers in America, according to the U.S. Bureau of Labor Statistics. And besides saving, they are also putting some of that money in the markets. Thanks to mobile apps like Robinhood, about a quarter of them own stocks. And another 14 per cent are building retirement accounts, according to the report.