Aug 26, 2022

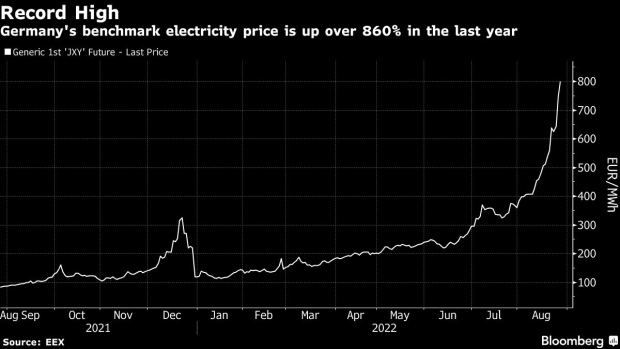

German Power Rises to Record 800 Euros in Latest Inflation Boost

, Bloomberg News

(Bloomberg) -- The price of power in Europe’s two key markets surged more 25% on Friday, a chaotic spike that will see the continent’s leaders hold an emergency meeting to find solutions to the crisis.

Electricity for next year in Germany and France -- both beset by their own severe crises -- are setting almost records almost daily. That’s because Russia is constricting the supply of natural gas and also, in the case of France, an ongoing slump in nuclear generation.

The European Union is to call an emergency meeting of energy ministers to discuss bloc-wide solutions. The surge is fueling inflation and threatening the finances of households and businesses across the continent.

Prices are at a level no one can afford because of “market failure”, Czech Prime Minister Petr Fiala said on Friday afternoon, adding that a pan-European solution doesn’t have to require a price cap. His country currently holds the EU’s rotating presidency.

Across Europe, governments have begun to take the drastic step of limiting energy use. In the UK, household bills are set to jump in October after a cap on costs was lifted. The soaring prices looks set to force millions of people to curb consumption.

“The French market is going to be extremely tight this winter, especially if we have low wind conditions,” said Kathryn Porter, energy consultant at Watt-Logic. “Everyone in Europe could be trying to import power at the same time and that could create huge challenges and rationing of industrial use.”

The French year-ahead contract rose as much as 25% to 1,130 euros a megawatt-hour on the European Energy Exchange AG Friday. The German equivalent also gained to a record, rising as much as 33% to 995 euros a megawatt-hour for a gain of about 70% this week. In oil market terms, it’s the equivalent of over $1,600 a barrel.

The surge comes as European natural gas futures climbed for a sixth straight week.

Prices have also up following an announcement from utility Electricite de France SA that a number of its nuclear plants will come back online later than expected. Those units will be a key source of power this winter, especially while natural gas remains scarce.

France has traditionally been one of Europe’s biggest net exporters of electricity, but with annual nuclear output headed for the worst year in more than three decades, that status is now a thing of the past. Availability at EDF’s reactors is as low as 42% as of Friday, according to data from grid operator RTE.

Failure to contain the crisis risks spurring social unrest and political upheaval, if the supply crunch leads to blackouts and cold homes this winter. Europe’s politicians have already earmarked about 280 billion euros ($281 billion) to ease the pain of surging energy prices for businesses and consumers, but the aid risks being dwarfed by the scale of the crisis.

The high power prices could force industries to shut facilities or scale back -- and some may never turn back on. Fertilizer producers are operating far below capacity across the continent, threatening food and farming alike.

“Companies are halting production as they struggle to keep up with the surging cost,” said Kesavarthiniy Savarimuthu, an analyst at researcher BloombergNEF in London. “Inflationary pressure on end users will continue rising as more people working in the industrial sector start to get laid off.”

©2022 Bloomberg L.P.