Feb 13, 2023

Global Liquidity Drain Is Coming for Markets, Citi’s King Says

, Bloomberg News

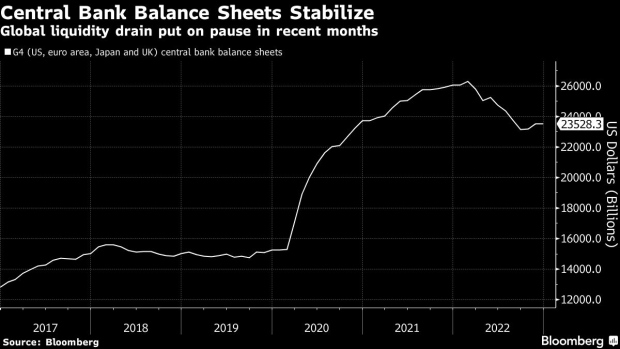

(Bloomberg) -- Risky assets may be in trouble now that one-off liquidity injections from global central banks that have been fueling a market rally in recent months have come to an end, according to Citi strategist Matt King.

In a report published Sunday, King pointed to interventions in recent months undertaken by the Bank of Japan and People’s Bank of China — as well as shifting line items on the European Central Bank’s and Federal Reserve’s balance sheets — that have added almost $1 trillion to global central bank reserves.

“The origins of this year’s risk rally lie in obscure technicals driving central bank liquidity,” King said in the report. “At this point we think most of the boost to reserves is done. This implies that the story for the rest of this year should return to being one of liquidity drainage and risk weakness.”

Financial markets have been buoyed globally since October as investors have read slowing inflation as a sign that central banks are getting closer to the end of their tightening campaigns, despite avowals from policymakers that there is still more work to be done.

According to King, the $1 trillion increase in reserves helps resolve the disconnect: It’s worth about a 10% boost for stocks, 50 basis points of tightening in investment-grade credit spreads and 200 basis points for high yield spreads, and “it is the actual addition or removal of such liquidity — and not just its announcement — which causes markets to move,” he said.

There have been four notable developments that account for the surge. In the US, declines in usage of the Fed’s overnight reverse repurchase agreement facility and money held in the Treasury’s general account have pushed cash into the banking system, stemming the drop in reserve balances that began in December 2021.

European governments have similarly withdrawn hundreds of billions of euro deposits from their accounts at the ECB since August, bolstering liquidity. In Japan, reserves have risen by about $200 billion as a result of the central bank’s yield-curve control program, while in China, the central bank’s ongoing liquidity operations amounted to about $400 billion in December alone, King said.

“Viewed individually and from one month to the next, or perhaps even quarterly, these movements may seem like noise,” he said. “It is, though, a noise which — especially when sufficiently aggregated — corresponds remarkably well with the noise of moves in risk assets.”

While it’s difficult to assess how central bank balance sheets will evolve going forward, King said the one-off liquidity injections are likely complete — though he acknowledged the outlook for the Fed’s balance sheet in particular remains uncertain due to the debt-ceiling drama in the US.

“When changes in even the least significant line items on central bank balance sheets can easily number in the hundreds of billions of dollars, they often outweigh changes in private sector liquidity and should inevitably command investors’ respect,” he said.

©2023 Bloomberg L.P.