Sep 1, 2023

Goldman says Canada to skip now, add final rate hike in October

, Bloomberg News

Population growth in the economy is too strong for us to see a hard landing: Strategist

The Bank of Canada will make its final rate increase in October after a pause next week, says Goldman Sachs Group Inc.

The central bank will take the latest data “as an encouraging signal that the latest hikes are working their way through the economy,” Goldman analyst Isabella Rosenberg said. She had previously viewed the chances of rate hike at the September meeting as “fairly high.”

Rosenberg is reining in her view on the central bank’s near-term rate path after a report Friday showed Canada’s economy unexpectedly contracted in the second quarter. Canada may already be in the middle of a technical recession, if output shrinks again in the third quarter. Policy makers in Ottawa will decide on the key rate on Sept. 6.

The Canadian dollar is poised to strengthen against the euro, according to Rosenberg.

“The loonie should benefit from a better U.S. growth outlook, particularly versus the euro where the incoming growth data have been on the weaker side,” she said.

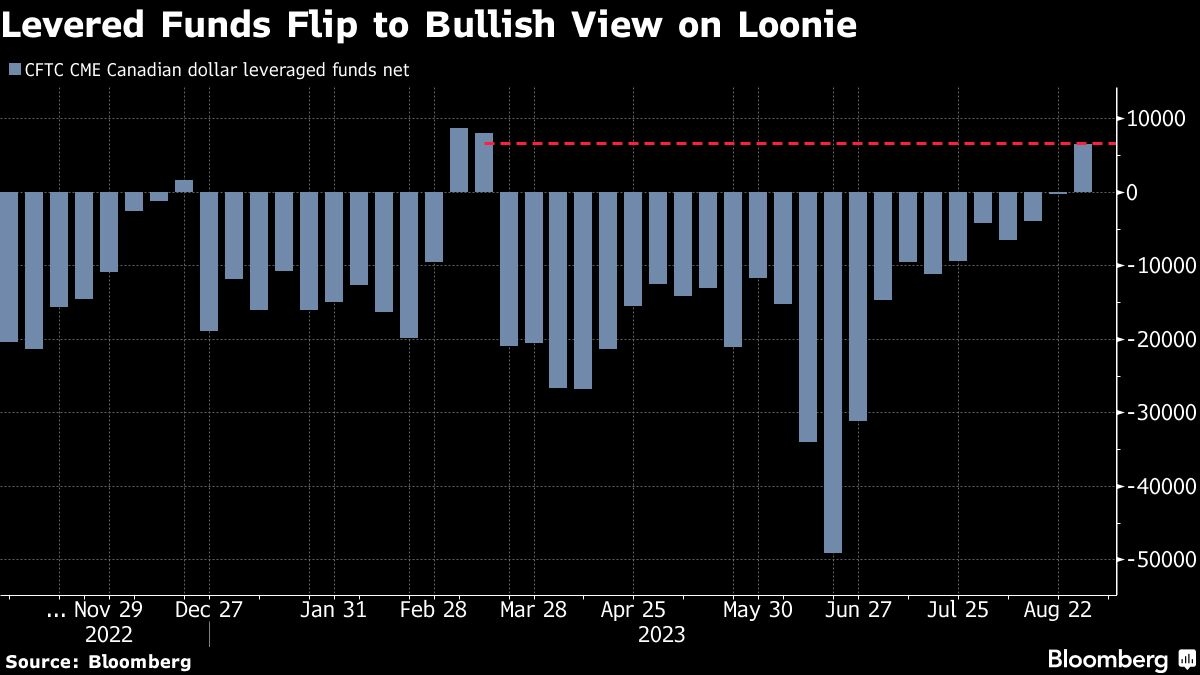

Sentiment may already be improving for the loonie. Leveraged funds shifted to a bullish view on the Canadian dollar for the first time since March, according to weekly Commodity Futures Trading Commission data through Aug. 29.

The loonie is set to strengthen to 1.43 per euro in three months, Rosenberg forecast. It had been trading near 1.46 on Friday afternoon in New York. A dollar gauge gained with the rise in Treasury yields as markets contemplate whether or not the Federal Reserve needs to do more to combat inflation in the face of a resilient economy.