Aug 15, 2023

Hawaiian Electric’s Municipal Bonds Tumble Amid Maui Fire Probe

, Bloomberg News

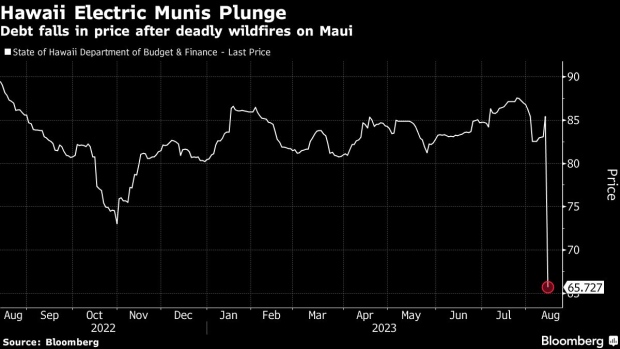

(Bloomberg) -- Municipal bonds sold for Hawaiian Electric Industries, which operates the utility that serves Maui, have joined the company’s stock in plunging amid scrutiny over the company’s possible role in the island’s deadly wildfire.

On Monday, investment-grade muni bonds that were sold for the company’s subsidiary, Hawaiian Electric Co., and are due in 2039 traded at about 65.7 cents on the dollar on average. That compares with above 80 cents in the days before the catastrophe, according to data compiled by Bloomberg.

Separate muni debt due in 2049 traded as low as about 63 cents on the dollar on Tuesday, down from an average of 71 cents on Monday.

On Tuesday, Hawaiian Electric’s long-term rating was cut to junk by S&P Global Ratings. The ratings company cited class action lawsuits recently filed against the company and its subsidiaries, which have “increased the risk of a material deterioration in HEI’s credit quality” if the plaintiffs prevail.

Read More: Hawaiian Electric Extends Record Slump With Future in Doubt

Hawaiian Electric, has come under criticism for not turning off power despite weather forecasters’ warnings that dry, gusty winds could create critical fire conditions. Plaintiffs attorneys are focusing on the utility’s equipment as a possible source of ignition. The company’s stock extended declines Tuesday. No official cause has been identified for the fire, which has become the deadliest in the US in more than a century.

Hawaiian Electric Co. has about $495 million of muni bonds outstanding, according to data compiled by Bloomberg. It most recently tapped the muni market in 2019 to refund debt with higher interest rates.

The state’s attorney general said Friday that she was opening an investigation into how authorities responded to the wildfires.

--With assistance from Mark Chediak.

©2023 Bloomberg L.P.