May 17, 2021

Monday.com and 1stDibs.com File for U.S. IPO

, Bloomberg News

(Bloomberg) -- Software maker Monday.com Ltd. and luxury online retailer 1stDibs.com Inc., both backed by venture capital firm Insight Partners, filed on Monday to go public in what may be a bellwether week for U.S. listings.

Both companies in filings with the U.S. Securities and Exchange Commission listed the size of their initial public offerings as $100 million, a placeholder amount that will likely change. Their filings came after a volatile week of trading that led at least three companies to delay their IPOs.

Read more: IPOs Are Getting Delayed as Volatility Spooks Debutants (1)

More deals are slated to price this week, including listings from Oatly Group AB and Procore Technologies Inc. Website maker Squarespace Inc. is also set to go public through a direct listing.

Monday.com, an Israeli workplace management software maker, was valued at $2.7 billion last year, Bloomberg News reported. It reported $59 million in revenue in the first three months of 2021, an 85% jump from the same period last year, its filing showed.

Principal shareholders include Insight Partners, Stripes Holdings, Sonnipe Ltd. and three Monday.com executives.

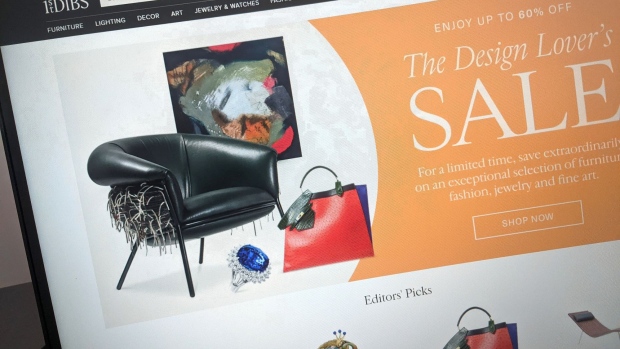

New York-based 1stDibs.com, which sells luxury goods like diamond accessories and vintage paintings, could seek a valuation of more than $1 billion, Bloomberg News has reported. Its backers include Benchmark Capital, Insight Partners, T. Rowe Price Group Inc., Spark Capital and Index Ventures.

Monday.com is working with Goldman Sachs Group Inc. and JPMorgan Chase & Co. on its listing while 1stDibs.com is working with Bank of America Corp., Barclays Plc., Allen & Co. and Evercore Inc.

©2021 Bloomberg L.P.