Jun 16, 2023

Oil holds biggest jump in six weeks on signs of China stimulus

, Bloomberg News

'We clearly don't have a demand problem' amid oil sector :Ninepoint Partners

Oil was steady after jumping the most in six weeks on Thursday as a weaker dollar and expectations for more stimulus in China outweighed concerns over higher interest rates in the U.S. and Europe.

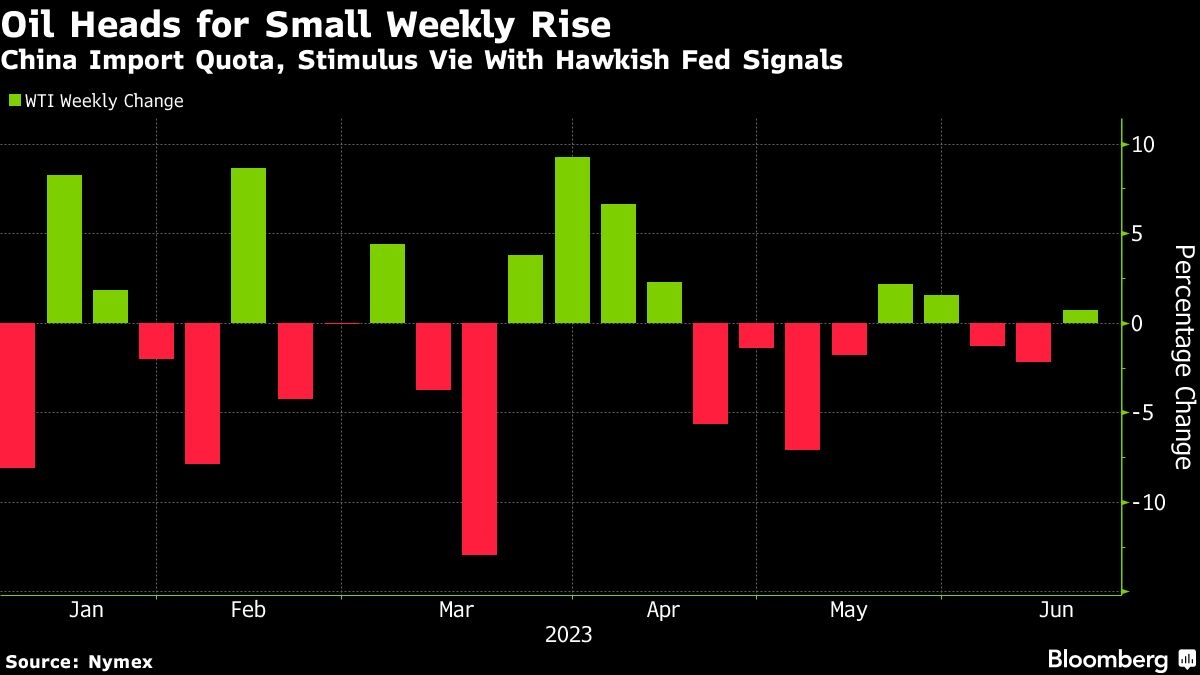

West Texas Intermediate held above US$70 a barrel after jumping 3.4 per cent in the previous session, putting it on course for a modest weekly gain.

In a volatile week for prices that has seen crude move by more than US$2 on three occasions, the market continues to send mixed signals. On the one hand, there has been a rally in refined fuels, particularly in the U.S. where gasoline's premium over crude hit an 11-month high. On the other, key timespreads for US crude and the Brent benchmark are now in a bearish contango structure, an indication of oversupply.

Those signals have come alongside a slew of macroeconomic influences. China loosened monetary policy this week to revive its stalled recovery and there are expectations it will announce more targeted stimulus. The dollar is on track for its biggest weekly drop since January, making oil cheaper for most buyers, while the Federal Reserve paused its rate hikes but signaled borrowing costs will keep going higher.

“Its been a pinball week where uncertainty rules,” said PVM Oil Associates analyst Tamas Varga. “Investors nervously react to developments” whether they be supply-demand estimates, inventory figures, interest rate decisions or economic data.

Prices:

- WTI for July delivery fell 0.2 per cent to US$70.49 a barrel at 9:55 a.m. in London.

- Brent for August settlement dipped 0.1 per cent to US$75.63 a barrel.